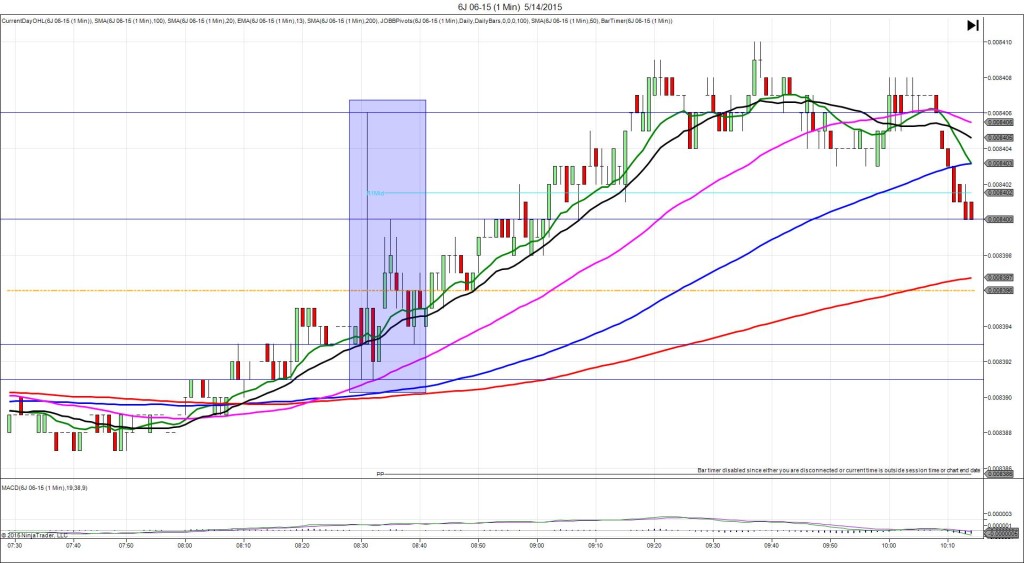

5/14/2015 Weekly Unemployment Claims / Trade Balance (0830 EDT)

Forecast: 272K

Actual: 264K

TRAP TRADE – INNER TIER

Anchor Point @ 0.008395

————

Trap Trade:

)))1st Peak @ 0.008406 – 0830:01 (1 min)

)))11 ticks

)))Reversal to 0.008391 – 0831:36 (2 min)

)))-15 ticks

————

Pullback to 0.008400 – 0835 (5 min)

9 ticks

Reversal to 0.008393 – 0839 (9 min)

7 ticks

Trap Trade Bracket setup:

Long entries – 0.008385 (just below the PP Pivot) / 0.008376 (just below the S1 Mid Pivot)

Short entries – 0.008403 (just above the R1 Mid Pivot) / 0.008415 (just above the HOD)

Notes: Report came in better than the forecast with 8k offset. The concurrently released PPI report was disappointing. This caused a quick and briefly sustained long spike of 11 ticks immediately. This would have filled the inner short entry at 0.8403 then slowly fallen 15 ticks in 90 sec to allow up to 11 ticks to be captured where it hovered just above the 50 SMA. Then it pulled back 9 ticks in 3 min before reversing 7 ticks in 9 min.