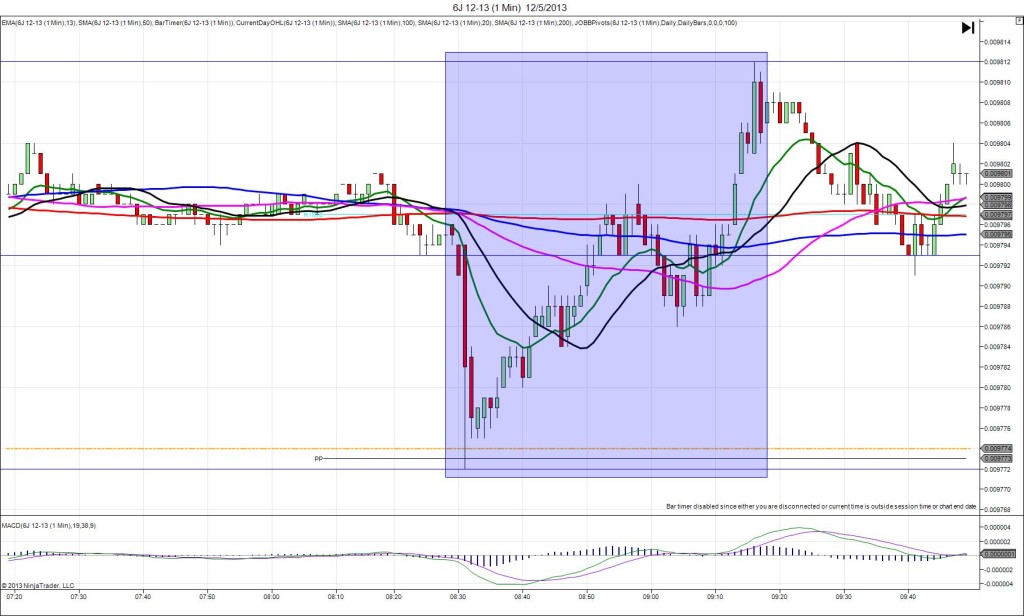

1/16/2014 Weekly Unemployment Claims (0830 EST)

Forecast: 327K

Actual: 326K

TRAP TRADE (DULL REACTION)

Anchor Point @ 0.0009565 (last price and recent avg)

————

Trap Trade:

)))Dull Reaction with only 5 ticks span of movement within first 20 sec

————

Trap Trade Bracket setup:

Long entries – 0.009555 (just below the 200 SMA) / 0.009545 (just below the S1 Pivot)

Short entries – 0.009574 (just above the PP Pivot ) / 0.009583 (just above the R1 Mid Pivot)

Notes: Report came in nearly matching again and the CPI releasing at the same time was matching. This should have been a good setup for the trap trade approach, but was dull instead. This caused a muted reaction of only 5 ticks on the :31 bar in the first 20 sec. With no impulse to fill either trap order, cancel the order. Notice if you left the trap on the board, the inner tier sell order may have filled late in the :31 bar, then only given 4-5 ticks before continuing upward. With this report, we are looking to take advantage of a quick impulse and the sharp pullback, not a late tame move.