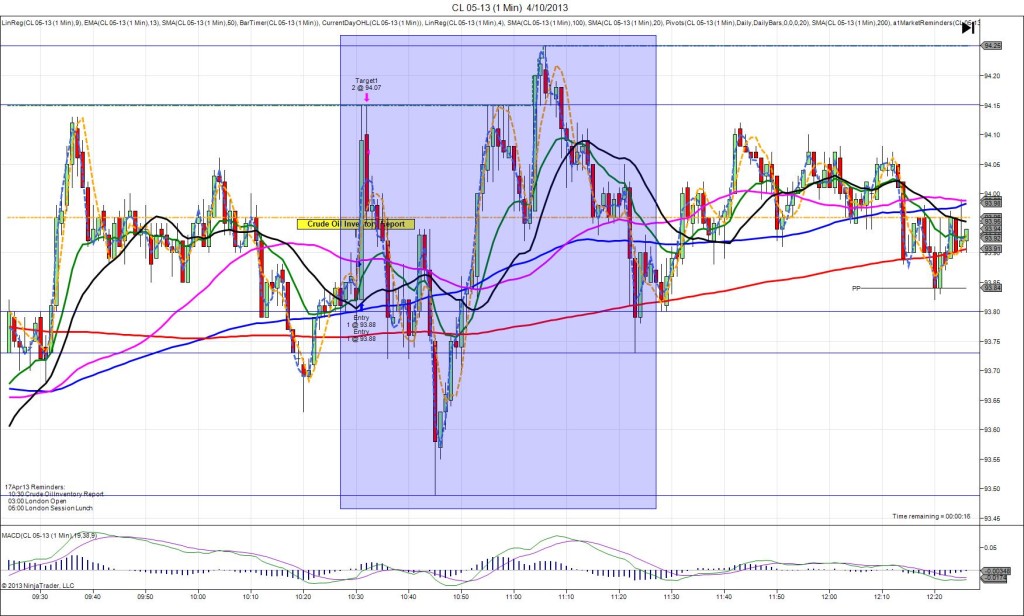

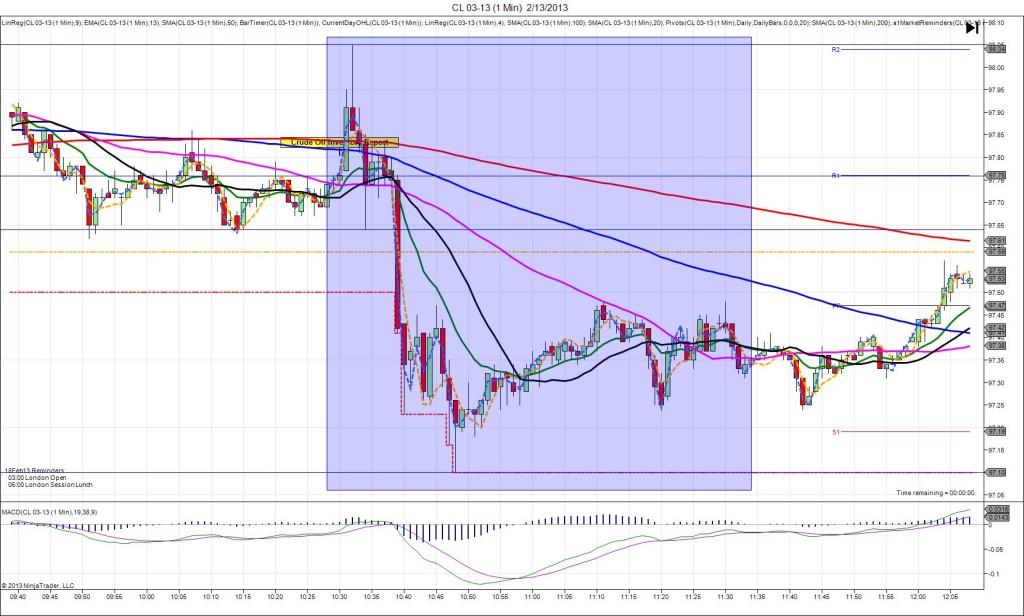

Caption for 4/10:

4/10/2013 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 1.6M

Actual: 0.3M

SPIKE WITH 2ND PEAK

Started @ 93.80

1st Peak @ 94.15 – 1031 (1 min)

35 ticks

Reversal to 93.49 – 1045 (15 min)

66 ticks

2nd Peak @ 94.25 – 1106 (36 min)

45 ticks

Reversal to 93.73 – 1123 (53 min)

52 ticks

Notes: Minimal gain in crude inventories when a larger gain was expected, while gasoline saw a moderate gain and distillates were nearly flat. This prompted a long move of 35 ticks on the first bar as the crude reading won the battle taking it to the HOD. With JOBB and a 10 tick buffer, you would have filled long at 93.92 with 32ticks of slippage. Look to exit near the HOD at about 94.10 for 18 ticks. After the peak at the HOD, the gain in gasoline took the market short for 66 ticks in 14 min, crossing all 3 SMAs and the PP Pivot. Then it rebounded for a slightly larger 2nd peak of 10 more ticks in about 20 min. The final reversal eclipsed the PP Pivot and 200 SMA for 52 ticks in 17 min. After that it chopped sideways.