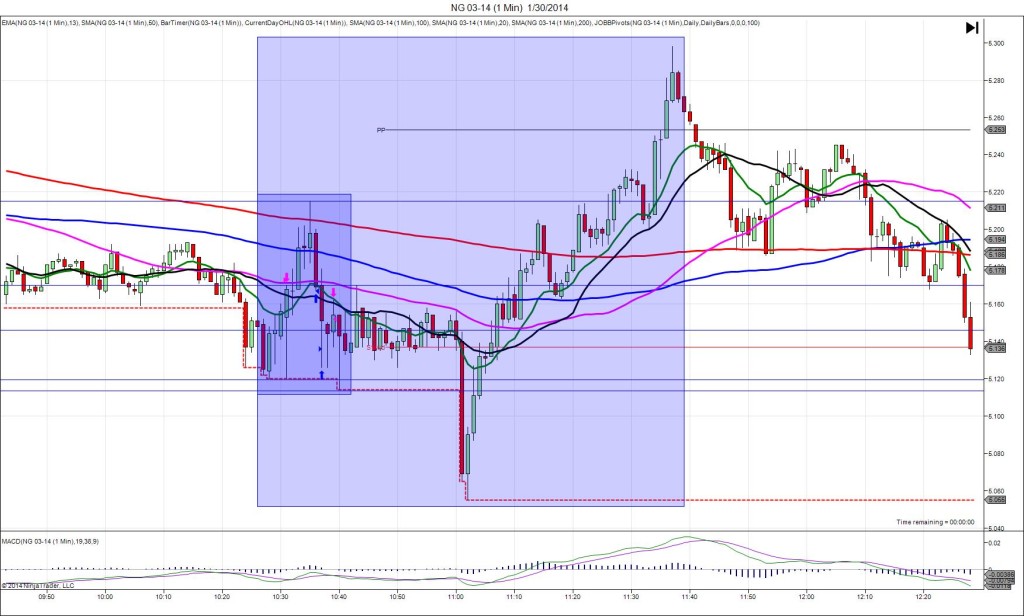

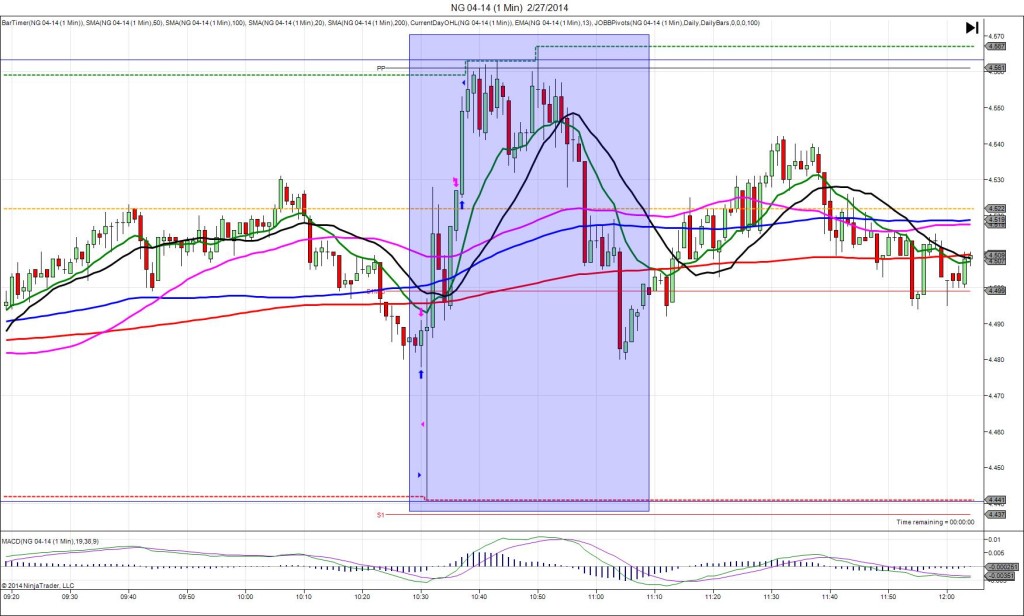

1/30/2014 Weekly Natural Gas Storage Report (1030 EST)

Forecast: -225B

Actual: -230B

SPIKE WITH 2ND PEAK

Started @ 5.146 (1029)

1st Peak @ 5.170 – 1031 (1 min)

24 ticks

Reversal to 5.120 – 1031 (1 min)

50 ticks

2nd Peak @ 5.216 – 1035 (5 min)

70 ticks

Reversal to 5.113 – 1040 (10 min)

103 ticks

Notes: Slightly larger draw on the reserve compared to the forecast saw a 24 tick long spike on the :31 bar where the movement on the :30 bar would have filled your long entry. The spike initially crossed the 13 SMA prior to the release, then the 20 SMA and almost the 50 SMA after the release. With JOBB, you would have filled long at 5.156 with no slippage on the :30 bar at 5.156. It would have backed off then hovered between 8 ticks in the red and 4 ticks in the profit. The safe play is to close out close to breakeven if you are filled with minimal momentum on the :30 bar. After the release, it continued long for another 10 ticks, then reversed on the back end of the :31 bar for 50 ticks to the LOD, before closing out the bar at the top again. Then it achieved a 2nd peak of 46 more ticks, eclipsing the 200 SMA, before reversing 103 ticks back to the LOD again. It continued to chop sideways above the S1 Mid Pivot before a dramatic 80 ticks drop at 1100, then a 240 tick reversal in the next 35 min.