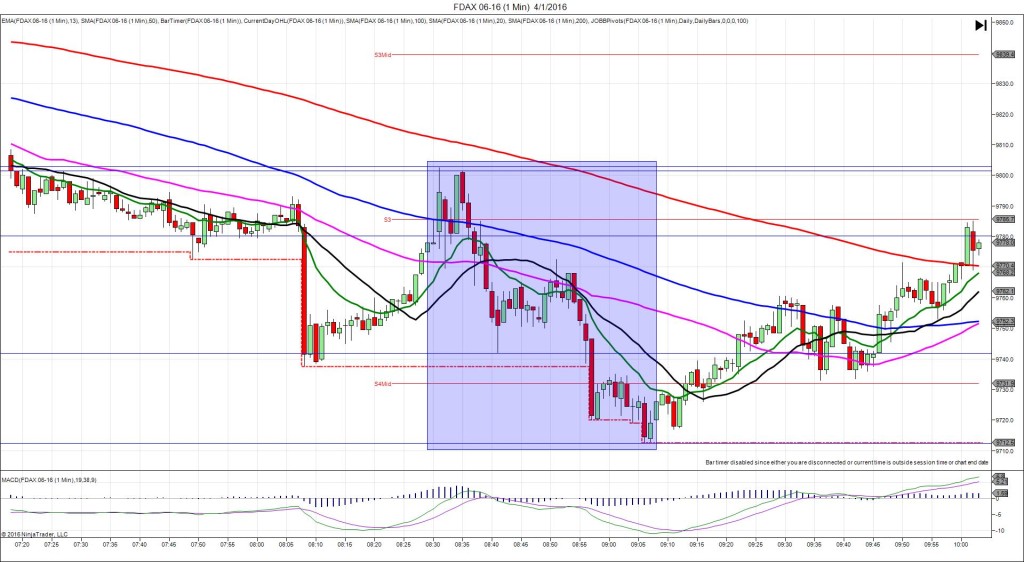

4/1/2016 Monthly Unemployment Report (0830 EDT)

Non Farm Jobs Forecast: 206K

Non Farm Jobs Actual: 215K

Previous Revision: +3K to 245K

Rate Forecast: 4.9%

Rate Actual: 5.0%

SPIKE WITH 2ND PEAK

Started @ 9780.5

1st Peak @ 9792.0 – 0830:11 (1 min)

23 ticks

Reversal to 9776.0 – 0830:21 (1 min)

32 ticks

2nd Peak @ 9802.5 – 0830:45 (1 min)

44 ticks

Reversal to 9769.5 – 0832 (2 min)

66 ticks

Pullback to 9801.5 – 0835 (5 min)

64 ticks

Reversal to 9742.0 – 0841 (11 min)

119 ticks

Pullback to 9772.5 – 0851 (21 min)

61 ticks

Reversal to 9712.5 – 0906 (36 min)

120 ticks

Expected Fill: 9785.5 (long)

Slippage: 0 ticks

Best Initial Exit: 9791.0 – 11 ticks or 9802.0 – 33 ticks

Recommended Profit Target placement: 9870.0 (just above the HOD) – move lower

Notes: The near matching report and conflict on the numbers versus the rate caused a small and oscillating reaction. Your would have had a no slippage long fill, then the exit would have varied greatly. 1. If quick you could have gleaned up to 11 ticks in the first 11 sec. If you did not adjust the stop then it would have barely absorbed the heat and allowed up to 33 ticks later in the bar. However, if the stop was adjusted any it would have taken you out for a loss. After that it reversed to the 50 SMA before pulling back for a double top. Then it stepped lower on a overall downtrend in the next 30 min.