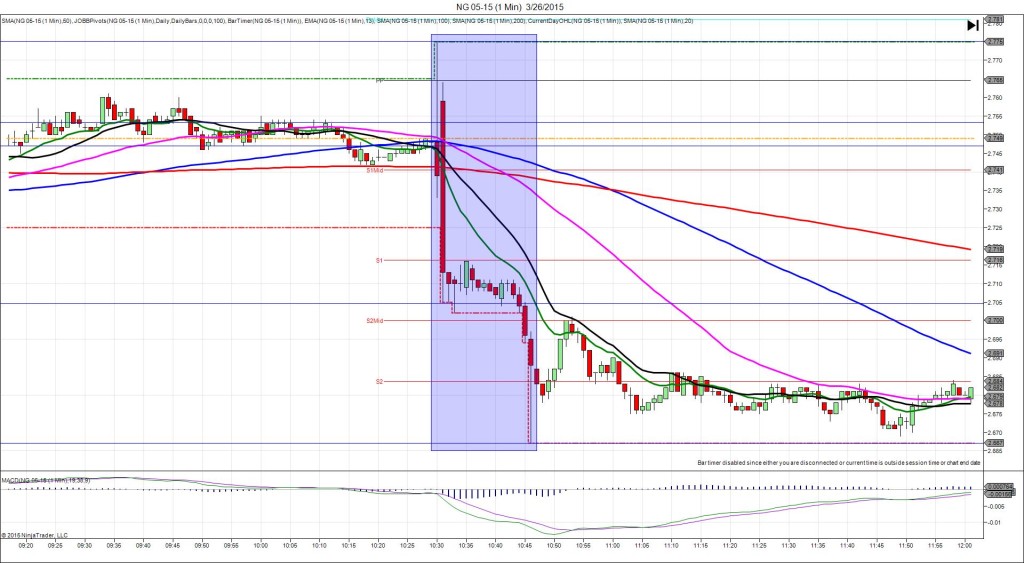

3/26/2015 Weekly Unemployment Claims (0830 EDT)

Forecast: 291K

Actual: 282K

TRAP TRADE – DULL NO FILL

Anchor Point @ 0.008434

————

Trap Trade:

)))1st Bar Span 0.008432 – 0.008436 – 0831 (1 min)

)))3 ticks

————

Trap Trade Bracket setup:

Long entries – 0.008425 (no SMA / Pivot near) / 0.008414 (just below the R2 Mid Pivot)

Short entries – 0.008442 (just above the 200 SMA) / 0.008454 (just below the R3 Mid Pivot)

Notes: Report came in better than the forecast with 9k offset. This caused a muted response with the :31 bar only moving within a 4 tick range overall. This would have been an obvious scenario to cancel the order on the dull movement and small reaction. It continued to have no impulse until about 10 min after the report when something else probably caused it fall about 15 ticks then continue to drift lower.