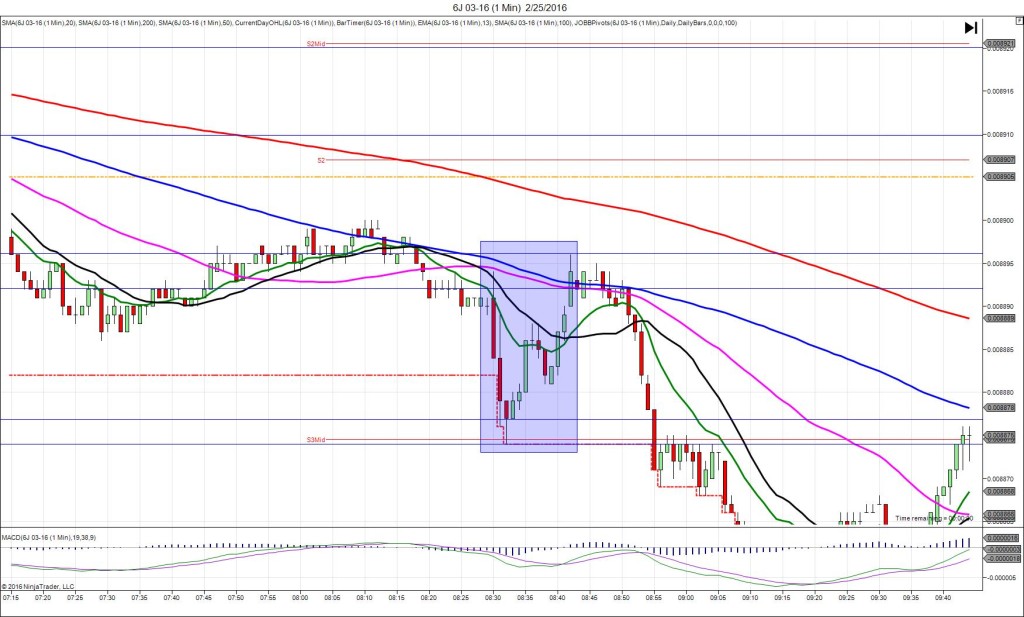

3/1/2016 Monthly ISM Manufacturing PMI (1000 EDT)

Forecast: 48.5

Actual: 49.5

Previous revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.008838

1st Peak @ 0.008816 – 1002:09 (3 min)

22 ticks

Reversal to 0.008827 – 1008 (8 min)

11 ticks

2nd Peak @ 0.008788 – 1039 (39 min)

50 ticks

Reversal to 0.008810 – 1059 (59 min)

22 ticks

Expected Fill: 0.008834 (short)

Slippage: 0 ticks

Best Initial Exit: 0.008817 – 17 ticks

Recommended Profit Target placement: 0.008824 (just below the S2 Mid Pivot / LOD)

Notes: Nice spike that carried through into the 3rd bar for over 20 ticks. Then a reversal to the falling 13 SMA offering a nice 2nd peak entry to ride the 13 SMA for 30+ ticks in 30 min to the S3 Mid Pivot.