4/8/2015 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 3.43M

Actual: 10.95M

Gasoline

Forecast: -1.04M

Actual: 0.82M

Distillates

Forecast: 0.83M

Actual: -0.25M

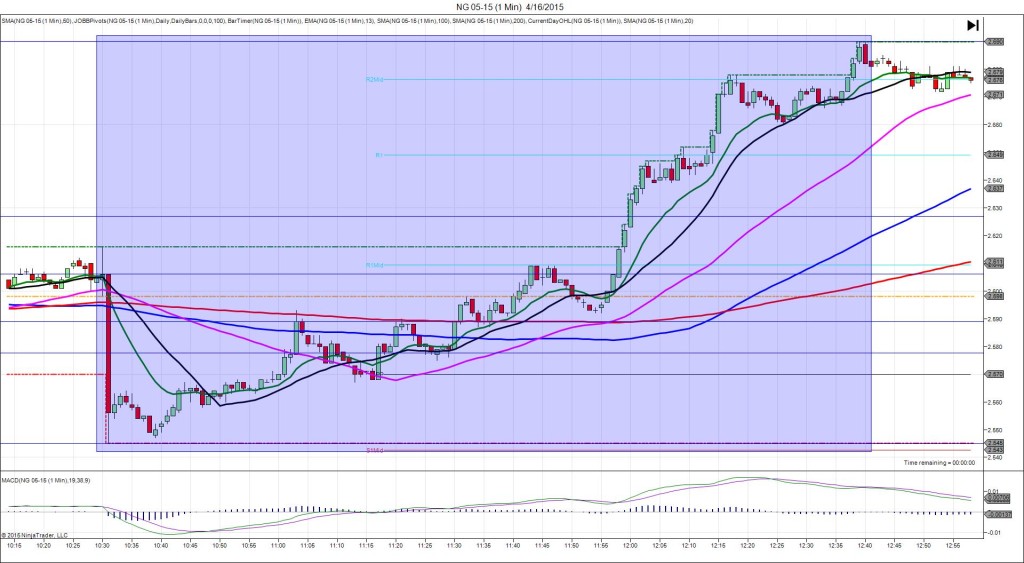

SPIKE WITH 2ND PEAK

Started @ 52.74

1st Peak @ 52.29 – 1030:46 (1 min)

45 ticks

Reversal to 52.64 – 1034 (4 min)

35 ticks

2nd Peak @ 51.38 – 1044 (14 min)

136 ticks

Reversal to 51.94 – 1059 (29 min)

38 ticks

Notes: Epic gain in inventories when a lesser gain was expected, while gasoline saw a negligible gain when a negligible draw was expected, and distillates saw a negligible draw when a negligible gain was expected. This caused a moderate short spike that started on the 200 SMA and fell for a total of 45 ticks in 46 sec as it crossed the S1 Mid Pivot and extended the LOD. With JOBB and a 10 tick buffer, you would have filled short at about 52.60 with 4 ticks of slippage, then you would have seen it chop twice between the low point and S1 Mid Pivot, so set your profit target at about 52.36 and wait for it to fill. It would have filled at 25 sec, then trickled a few more ticks lower before reversing 35 ticks in 3 min to cross the S1 Mid Pivot / 13 SMA. Then it (predictably) fell another 91 ticks in 10 min on a 2nd peak due to the historically high oil gain. After that it reversed 38 ticks in 15 min, crossing the 13/20 SMAs.