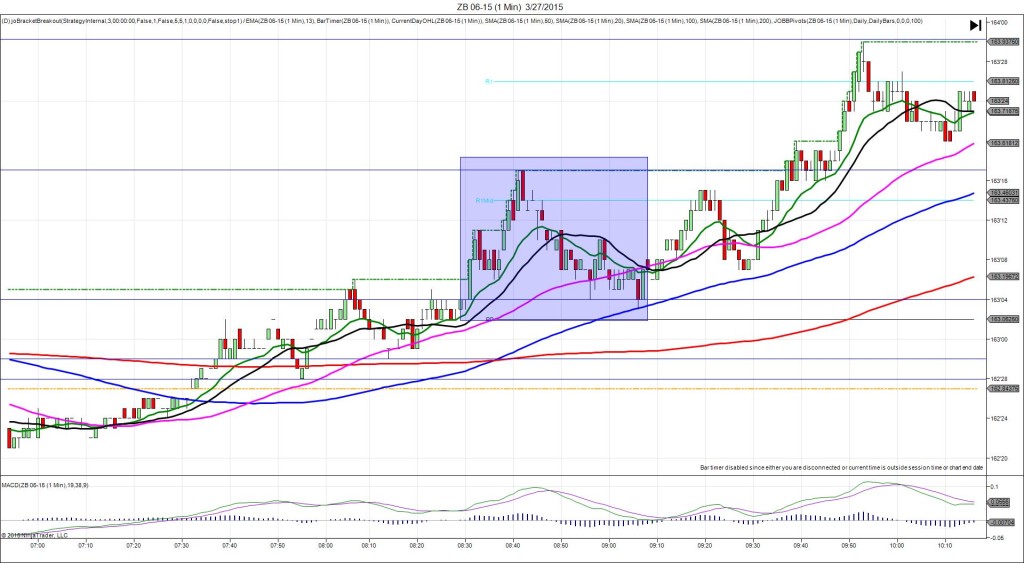

3/27/2015 Quarterly Final GDP (0830 EDT)

Forecast: 2.4%

Actual: 2.2%

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 163’04

1st Peak@ 163’11 – 0831:17 (2 min)

7 ticks

Reversal to 163’06 – 0836 (6 min)

5 ticks

2nd peak @ 163’17 – 0841 (11 min)

13 ticks

Reversal to 163’04 – 0856 (26 min)

13 ticks

Notes: Report fell short of the forecast by 0.2%, causing a long spike of 7 ticks over about 80 sec. As we mentioned in the alert, “if the result differs by 0.2% or less, look for a spike of 4-7 ticks”. Sure enough that was prophetic in this case. This did differ from the previous reports to drift into the :32 bar on the first peak, but other than that it was true to form. With JOBB and a 2 tick bracket, your long order would have filled at 163’06 with no slippage. Then be patient and set a profit target at 4 ticks since the HOD is the only resistance barrier. It would have filled nicely early in the :32 bar. After that it reversed 5 ticks in 4 min to the 13 SMA before climbing for a 2nd peak of 6 more ticks in 5 min as it crossed the R1 Mid Pivot. Then it reversed 13 ticks in 15 min as it crossed the 50 SMA.