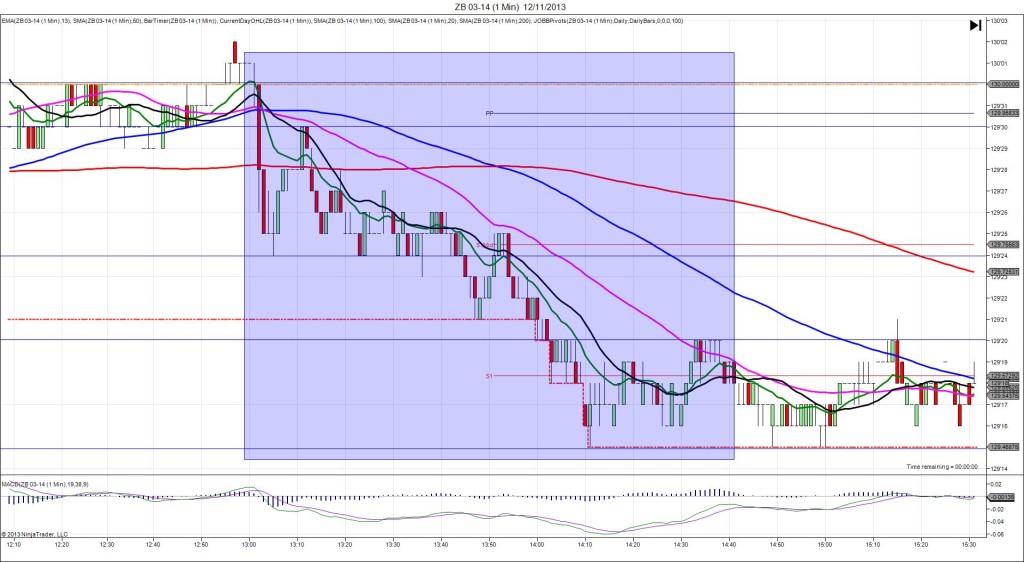

12/4/2013 Monthly Trade Balance (0830 EDT)

Forecast: -40.3B

Actual: -40.6B

Previous Revision: -1.2B to -43.0B

DULL REACTION (NO FILL)

Started @ 0.009755

1st Peak @ 0.009761 – 0832 (2 min)

6 ticks

Reversal to 0.009742 – 0839 (9 min)

19 ticks

Notes: Report barely fell short of the forecast with an offset of 0.3B. The news caused a dull move initially that did not stray more than 2 ticks away from the anchor point until late in the :31 bar, but eventually achieved 6 ticks on the :32 bar. With JOBB you would not have filled as you should have cancelled within 10 sec with no fill. With the strong ADP report 15 min earlier, the market was rebounding off of a large bearish move, so the reversal on this report was overlapping with the pursuit of a 2nd peak on the ADP. It achieved 19 ticks in 7 min, crossing the PP Pivot. After that, it backed off and stepped lower one more time.