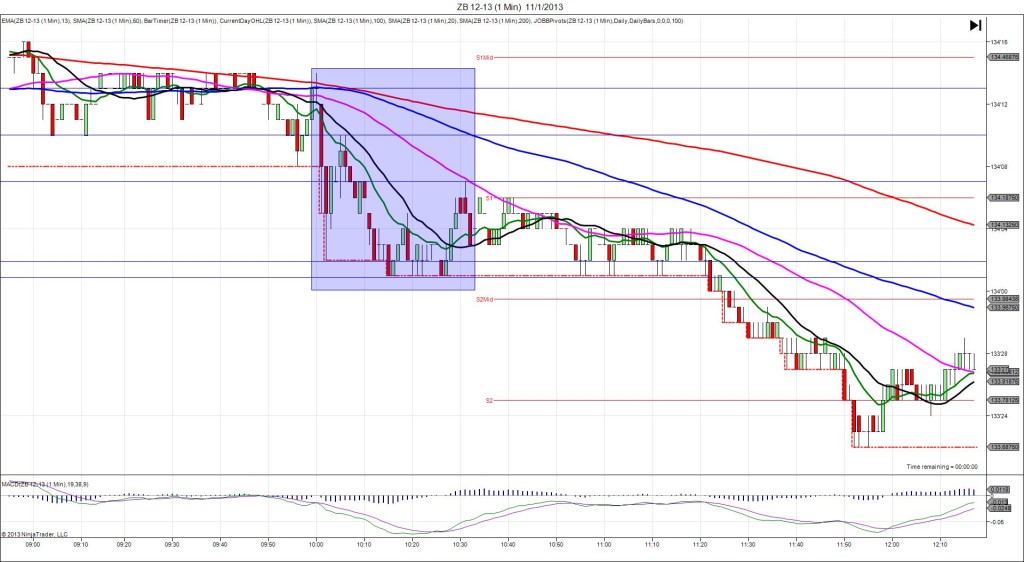

12/4/2013 ADP Non-Farm Employment Change (0815 EDT)

Forecast: 172K

Actual: 215K

Previous revision: +54K to 184K

DOWNWARD FAN

Started @ 129’26

1st Peak @ 129’10 – 0816 (1 min)

16 ticks

Reversal to 129’16 – 0817 (2 min)

6 ticks

Final Peak @ 129’01 – 0906 (51 min)

25 ticks

Reversal to 129’15 – 1004 (109 min)

14 ticks

Notes: Report strongly exceeded the forecast by 43K jobs along with a huge 54K upward revision to the previous report. This caused a short reaction of 16 ticks, peaking on the :16 bar as it collided with the S2 Pivot and extended the LOD. With JOBB, you would have filled short at about 129’19 with 4 ticks of slippage, then seen it hit the S2 Pivot immediately and slowly retreat. I would exit as it is backing off with 7 ticks, or place a target at 129’10 or 09 and wait for it to fill, which would have happened on the :18 bar. After the peak, it retreated 6 ticks to the S2 Mid Pivot, then oscillated between the pivots for about 10 min, before the falling 12 SMA caused it to fall into a downward fan that slowly achieved another 9 ticks in the next 40 min, almost to the 129’00 area. Then it reversed for 14 ticks in the next hour, back to the 200 SMA.