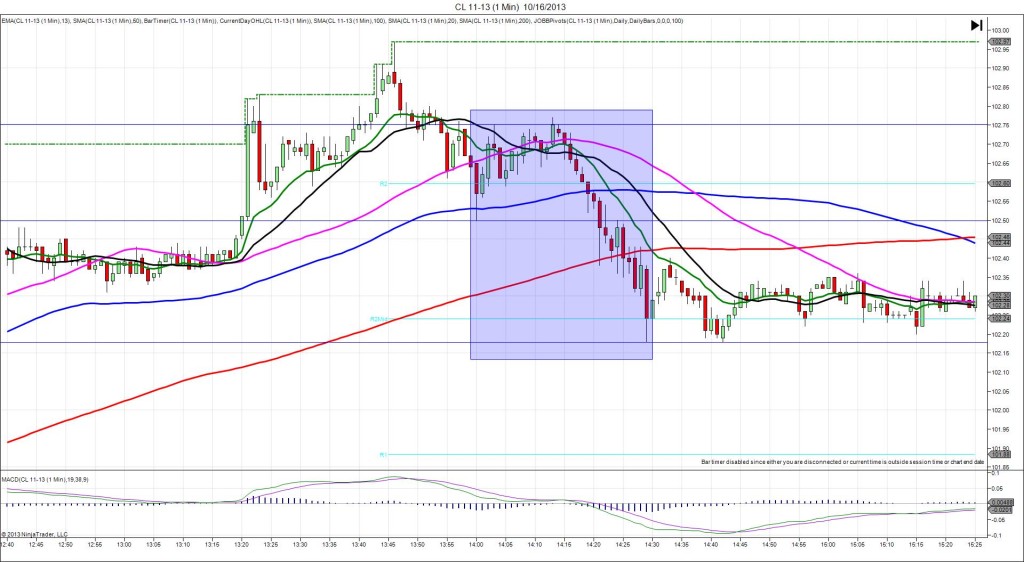

10/16/2013 FED Beige Book (1400 EDT)

Forecast: n/a

Actual: n/a

SPIKE / REVERSE

Started @ 102.50

1st Peak @ 102.75 – 1403 (3 min)

25 ticks

Reversal to 102.18 – 1429 (29 min)

57 ticks

Notes: The Federal Reserve said today that economic activity continued to expand at a modest to moderate pace during the reporting period of September through early October. Eight Districts reported similar growth rates in economic activity as during the previous reporting period, while growth slowed some in the Philadelphia, Richmond, Chicago, and Kansas City Districts. The DX had minimal movement, but did rally after 1405 to aid in the reversal. This resulted in a 25 tick long move in 3 bars that crossed the 50 SMA and the R2 Pivot. With JOBB, it would not have triggered the long entry on your bracket until about 30 sec into the :31 bar, but this is normal. You would have filled at 102.56 with 1 tick of slippage, then look for the 50 SMA as a target at about 102.68 for 12 ticks. After the peak, it rode the 50 SMA to gain 2 more ticks in the next 10 min. Then it reversed for 57 ticks in the next 26 min, crossing the 100/200 SMAs and the R2 Mid Pivot. After that it traded sideways using the R2 Mid Pivot as support.