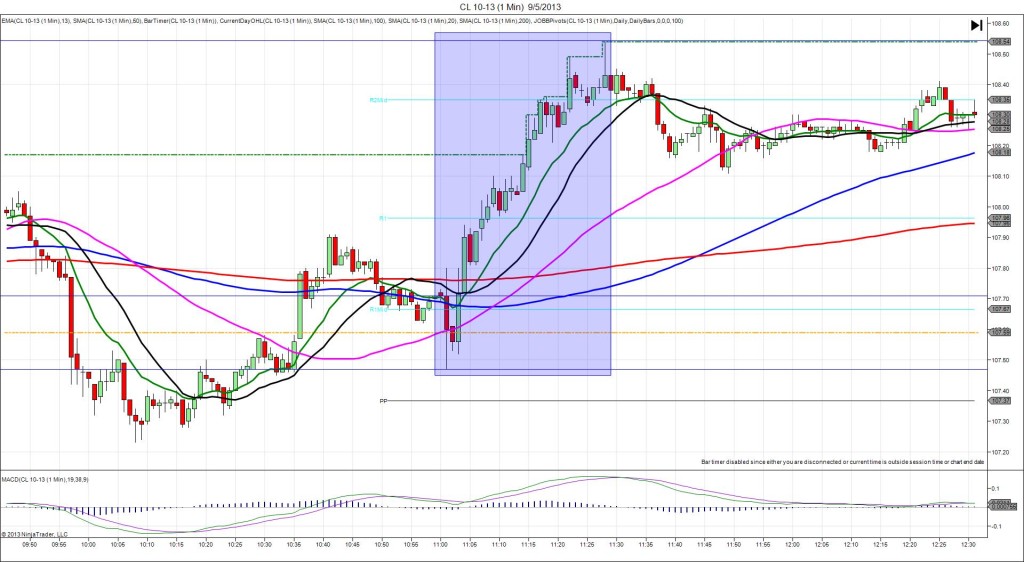

9/25/2013 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: -1.13M

Actual: 2.64M

Gasoline

Forecast: 0.14M

Actual: 0.22M

SPIKE WITH 2ND PEAK

Started @ 103.52

1st Peak @ 103.15 – 1031 (1 min)

37 ticks

Reversal to 103.38 – 1032 (2 min)

23 ticks

2nd Peak @102.82 – 1038 (8 min)

70 ticks

Reversal to 103.63 – 1131 (61 min)

81 ticks

Notes: Moderate gain in inventories when a negligible gain was expected, while gasoline results were nearly matching with a negligible gain. With the supply gains is crude driving the action, we saw a moderate short spike on the :31 bar that crossed the 50 SMA and the R1 Mid Pivot for 37 ticks. With JOBB and a 10 tick buffer, you would have filled short at 103.37 with 5 ticks of slippage, then seen it fall and hover between 3 and 14 ticks of profit. A target just below the R1 Mid Pivot at 103.16 would have filled 8 sec into the bar for 21 ticks. Otherwise, look to exit with about 10 ticks when it hovered. After the peak, it reversed for 23 ticks on the next bar, falling for a 2nd peak of 33 more ticks as it eclipsed the PP Pivot 5 min later. Then it reversed for 81 ticks crossing all 3 major SMAs and reaching the R2 Mid Pivot in less than an hour.