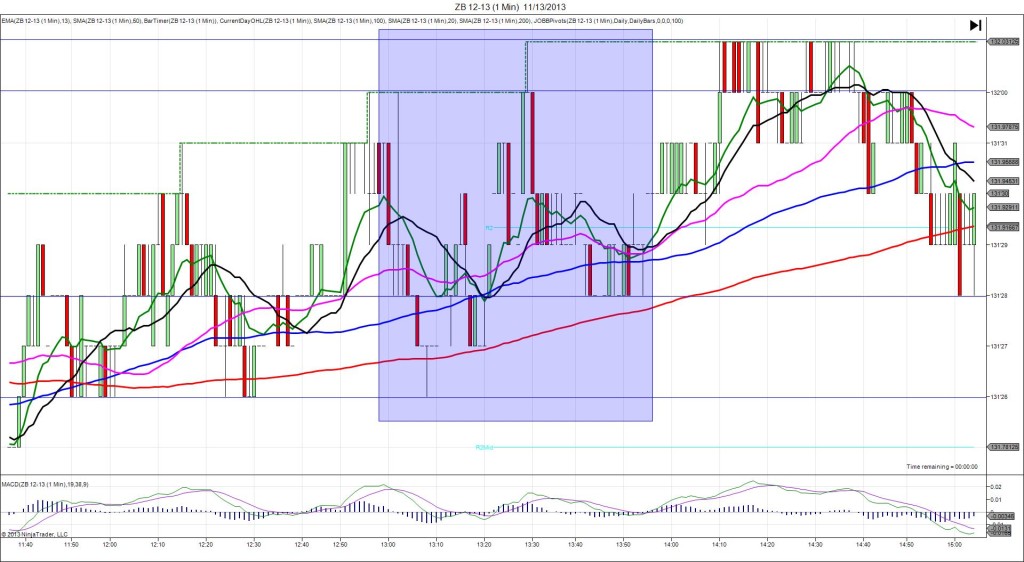

10/2/2013 ADP Non-Farm Employment Change (0815 EDT)

Forecast: 177K

Actual: 166K

Previous revision: -17K to 159K

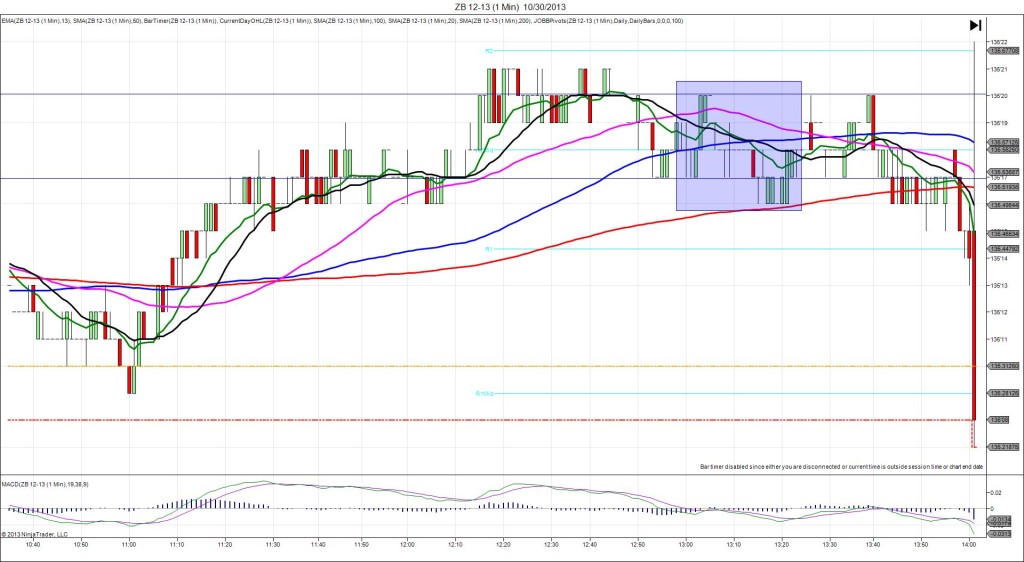

SPIKE WITH 2ND PEAK

Started @ 133’09

1st Peak @ 133’21 – 0817 (2 min)

12 ticks

Reversal to 133’15 – 0819 (4 min)

6 ticks

2nd Peak @ 133’24 – 0830 (15 min)

15 ticks

Reversal to 133’09 – 0927 (72 min)

15 ticks

Notes: Report fell short of the forecast by 11K jobs along with a sizeable 17K downward revision to the previous report. This caused a long reaction of 12 ticks, peaking on the :17 bar as it crossed the R2 Pivot and extended the HOD. With JOBB, you would have filled long at about 133’15 with 3 ticks of slippage, then it would have hovered around the fill point for a few sec, before gaining 6 more ticks into the :17 bar. A profit target at 133’18, just above the R2 Pivot would have filled easily. After the peak, it fell 6 ticks in 2 min, before rallying for a 2nd Peak of 3 more ticks at the bottom of the hour to the R3 Mid Pivot. Then it took about an hour to reverse 15 ticks back to the R1 Pivot.