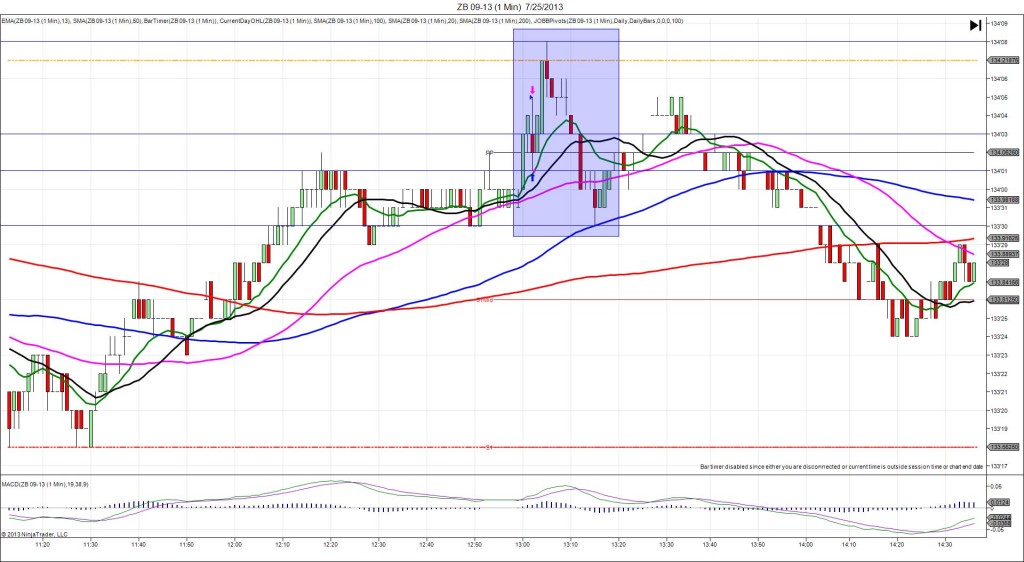

7/17/2013 FED Beige Book (1400 EDT)

Forecast: n/a

Actual: n/a

DULL REACTION…NO FILL

Started @ 135’11

1st Peak @ 135’07 – 1402 (2 min)

4 ticks

Reversal to 135’19 – 1451 (51 min)

12 ticks

Notes: The Federal Reserve said today that economic activity maintained a modest to moderate pace since the previous report across most Federal Reserve districts, bolstered by industries from housing to manufacturing. The DX was fairly flat until 1430 when it rallied mildly. This resulted in an initial dull 4 tick short move followed by a 12 tick reversal in the next 49 min. With JOBB, it would not have triggered the short entry on your bracket until about 45 sec into the :31 bar, so this would be reason to cancel the order. If you did not cancel and were waiting on a delayed reaction, move the stop loss in to -1 or -2 ticks, which would have been taken out on the next few bars. The initial spike found support on the R1 Pivot and the reversal crossed all 3 major SMAs and the R2 Pivot.