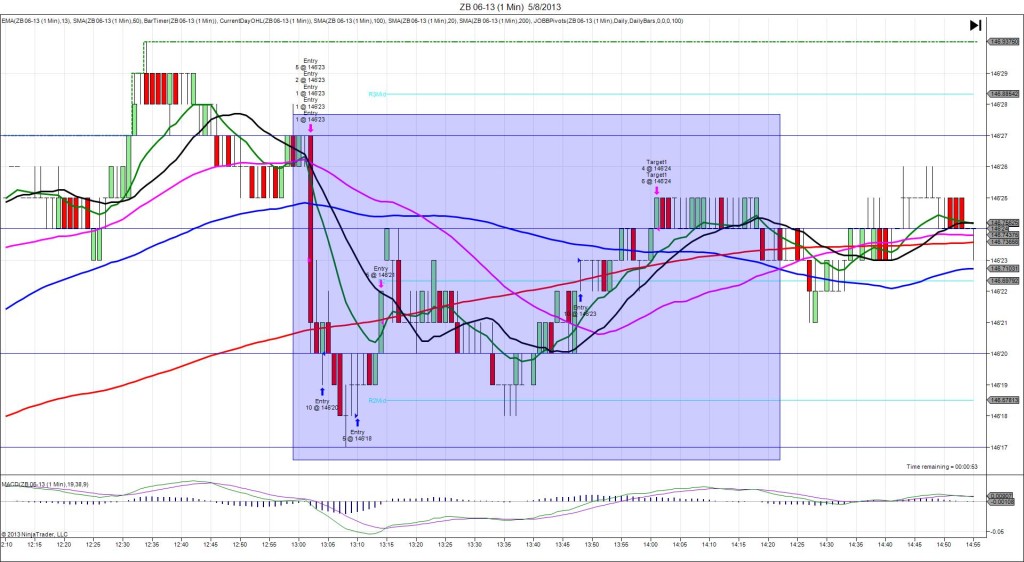

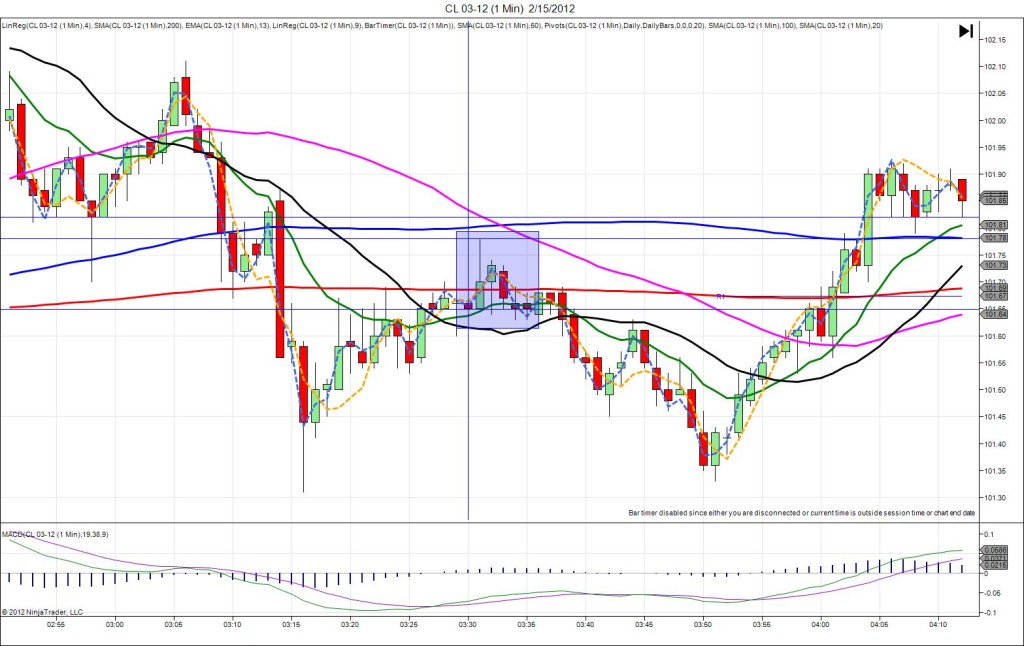

5/8/2013 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 2.1M

Actual: 0.2M

SPIKE/REVERSE

Started @ 96.16

1st Peak @ 96.36 – 1032 (2 min)

20 ticks

Reversal to 95.81 – 1041 (11 min)

55 ticks

Notes: Little change in crude inventories when a small gain was expected, while gasoline saw a small draw and distillates saw a moderate gain. Commercial oil inventories continue to be categorized as above their upper limit and reached a new record. This caused a long move of 20 ticks that eclipsed the 50 and 20 SMAs, and the R1 Pivot, peaking on the :32 bar. With JOBB and a 10 tick buffer, you would have filled long at about 96.27 with 1 tick of slippage, then seen it reverse and bounce between breakeven and 17 ticks in the red. Look to exit within 5 ticks of breakeven at or below the 50 SMA with a limit order. The :32 bar gave a few more ticks before the reversal began. In a volatile and choppy manner, it fell for 55 ticks in 11 min to eclipse the 200 SMA and OOD. After that it chopped sideways between the OOD and R1 Pivot.