5/1/2013 FOMC Statement / FED Funds Rate (1400 EDT)

Forecast: n/a

Actual: n/a

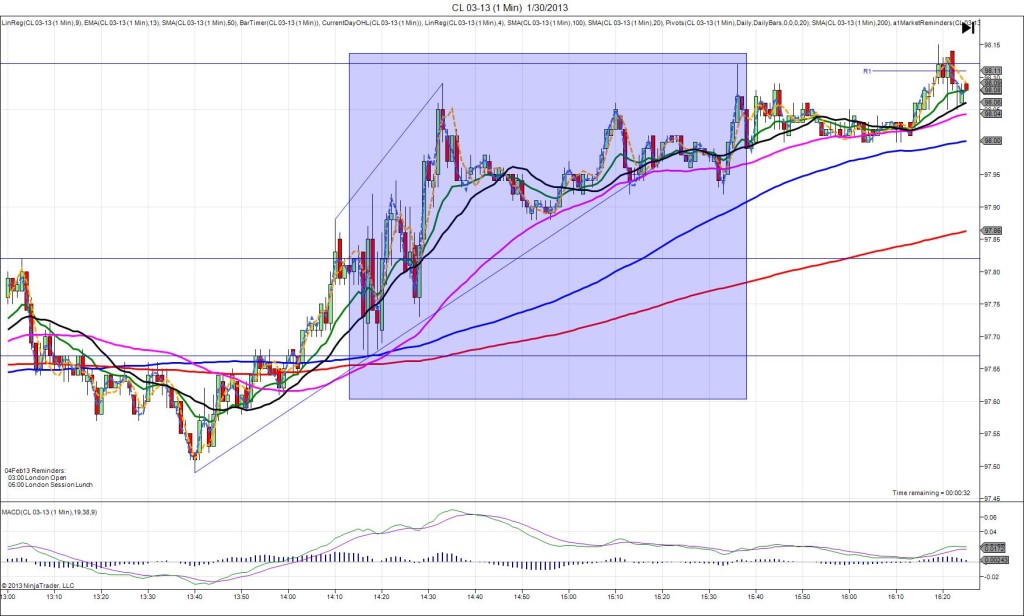

UPWARD FAN

Started @ 90.69 (1400)

1st Peak @ 90.92 – 1404 (4 min)

23 ticks

Final Peak @ 91.22 – 1453 (53 min)

53 ticks

Reversal to 90.90 – 1553 (113 min)

32 ticks

Notes: Report released on time, as the FED chose to continue the existing open ended QE3 policy despite seeing certain indications of improving economic conditions. This caused an initially choppy reaction which developed into an upward fan as the DX fell. We saw 53 ticks gained in a little less than an hour and into the pit close. Then it took another hour to slowly reverse for 32 ticks having to fight through the 50 and 100 SMAs. After seeing the news and the DX reaction in the first few minutes, it would be safe to buy the dips, when it dropped below the 100 SMA in the first 10 min, then stay in until the 13 crosses the 20 SMA.