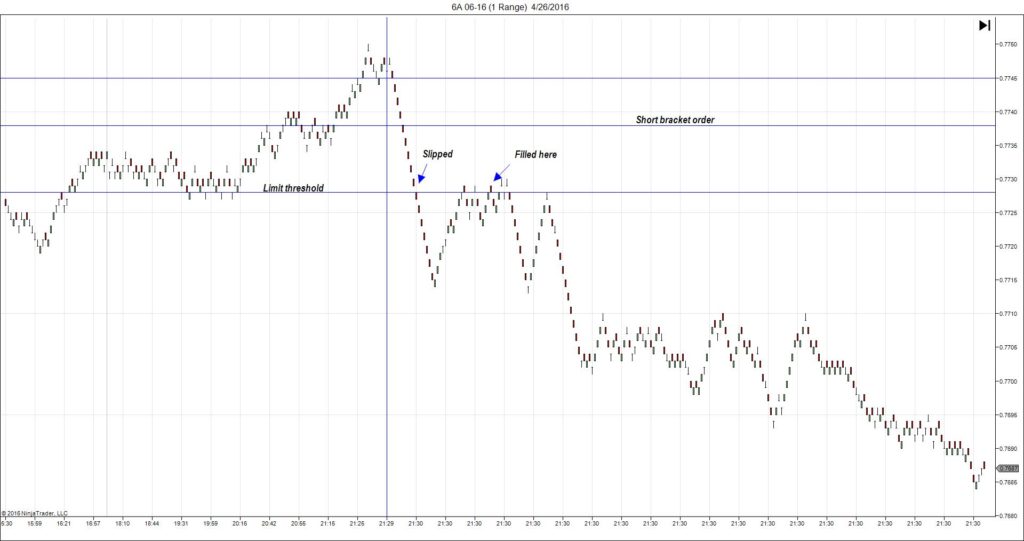

4/26/2016 Quarterly CPI / Trimmed Mean CPI (2130 EDT)

Forecast: 0.3%

Actual: -0.2%

Forecast: 0.5%

Actual: 0.2%

Previous Revision: n/a

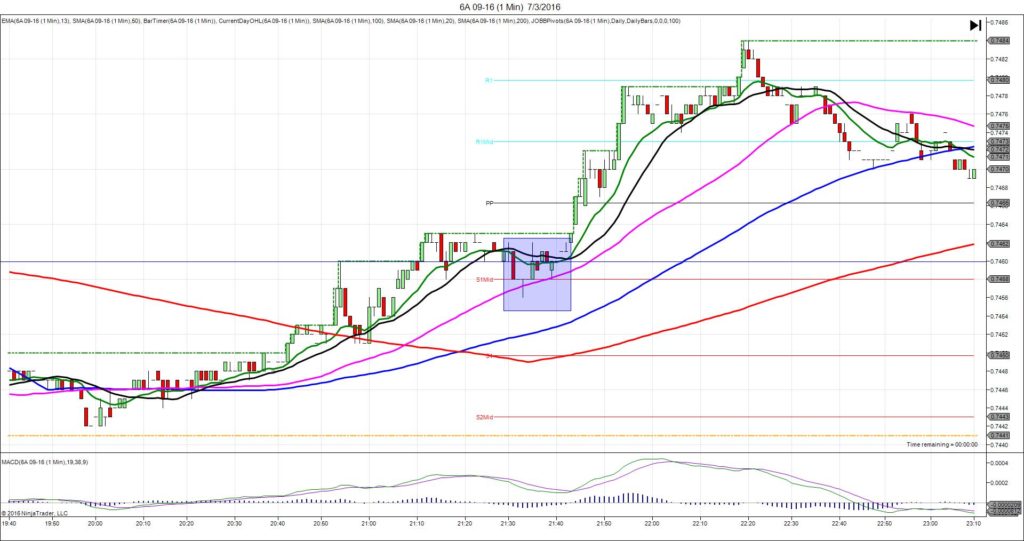

DOWNWARD FAN

Started @ 0.7745

1st Peak@ 0.7682 – 2130:39 (1 min)

63 ticks

Final Peak @ 0.7634 – 2202 (32 min)

111 ticks

Reversal to 0.7647 – 2209 (39 min)

13 ticks

Expected Fill: 0.7729 (short)

Slippage: 9 ticks

Best Initial Exit: 0.7683 – 46 ticks

Recommended Profit Target placement: 0.7703 (just below the S1 Pivot) / 0.7686 (just below the S2 Pivot)

Notes: Very disappointing report caused a large short reaction. The limit order settings would have worked nicely to provide a fill after slipped on a retracement. With the strong deviation of 0.5%, nice trend trade opportunity on the 2nd peak.