8/4/2013 Monthly Retail Sales (2130 EDT)

Forecast: 0.4%

Actual: 0.0%

Previous Revision: +0.1% to 0.2%

INDECISIVE

Started @ 0.8857

1st Peak @ 0.8883 – 2131 (1 min)

26 ticks

Reversal to 0.8825 – 2131 (1 min)

-58 ticks

Pullback to 0.8841 – 2132 (2 min)

16 ticks

Reversal to 0.8823 – 2140 (10 min)

18 ticks

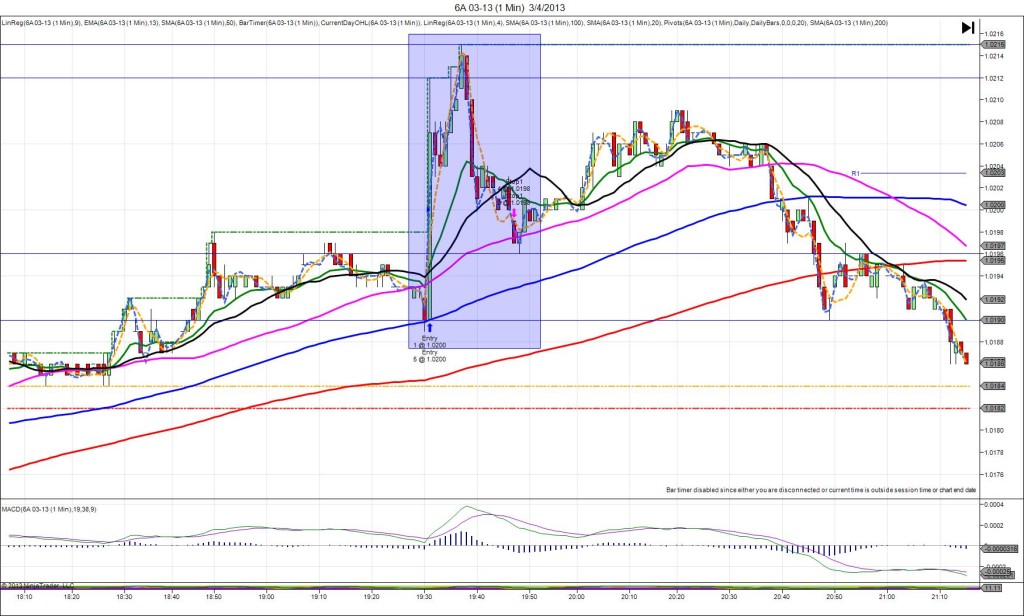

Notes: Report fell short of the forecast by 0.4%, with a small previous report upward revision caused an indecisive reaction. Due to the large long spike of 26 ticks, then rapid drop of 58 ticks with a good bearish disparity on the result, this is cause for concern. It rallied long to cross all 3 major SMAs (falling in a down trend) and nearly reach the OOD, then fell to cross the S1 Pivot. With JOBB you would have filled long at 0.8866 with about 5 ticks of slippage, then been stopped with a 16 tick loss including 6 ticks of slippage on the opposite entry as it was before the OCO could function. After the :01 bar, it oscillated above and below the S1 Pivot with a period of about 40 min. With June and July (not traded) also being indecisive, After this report we will be raising the risk rating to 3 for the foreseeable future.

-010813.jpg)

-120212.jpg)

-100312.jpg)