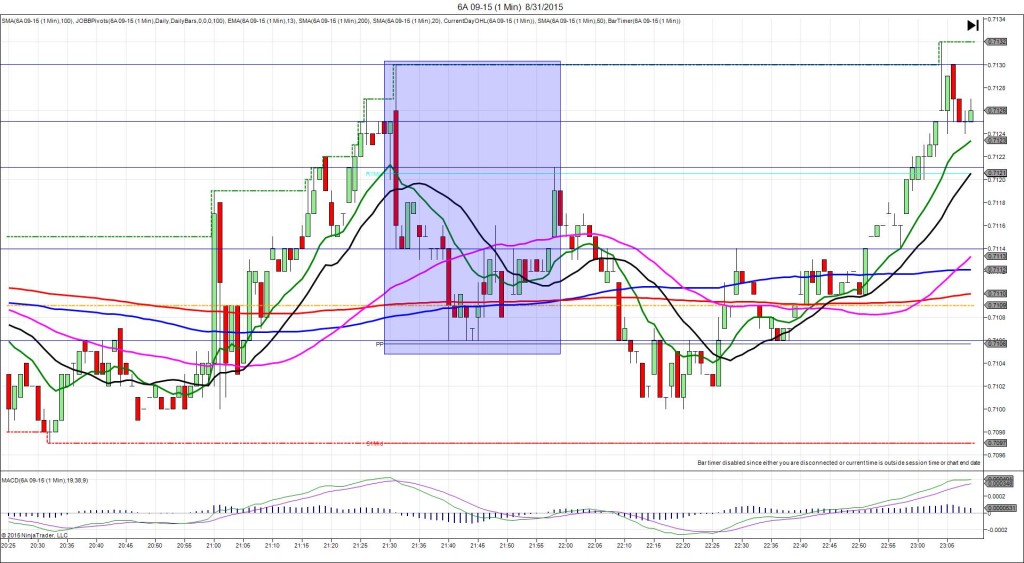

12/2/2014 Quarterly Advance GDP (1930 EST)

Forecast: 0.7%

Actual: 0.3%

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.8457

1st Peak@ 0.8399 – 1931:07 (1 min)

58 ticks

Reversal to 0.8406 – 1932 (2 min)

7 ticks

Final Peak @ 0.8386 – 1941 (11 min)

71 ticks

Reversal to 0.8397 – 1944 (14 min)

11 ticks

Extended Reversal to 0.8415 – 2109 (99 min)

29 ticks

Notes: Report missed the forecast by a large margin of 0.4% with no previous revision. This caused a large short spike of about 34 ticks immediately, then a slower descent for another 24 ticks in the next 64 sec to eclipse the S2 Pivot. With JOBB and a 17 tick bracket, your short entry would have filled at 0.8435 with 5 ticks of slippage, then you would have seen it continue to fall and eventually hover around 0.8401 to allow 34 ticks to be captured. Once you see the strong offset on the result, be patient on the exit as it will peak late. Small reversals and stepping additional peaks are normal in these situations. It reversed for only 7 ticks in the next minute before falling for a final peak for 13 more ticks in the next 9 min. Then it reversed 11 ticks in 3 min and another 18 ticks in the next 85 min as it crossed the S2 Pivot.