1/5/2015 Monthly Trade Balance (1930 EST)

Forecast: -1.59B

Actual: -0.93B

Previous Revision: +0.44B to -0.88B

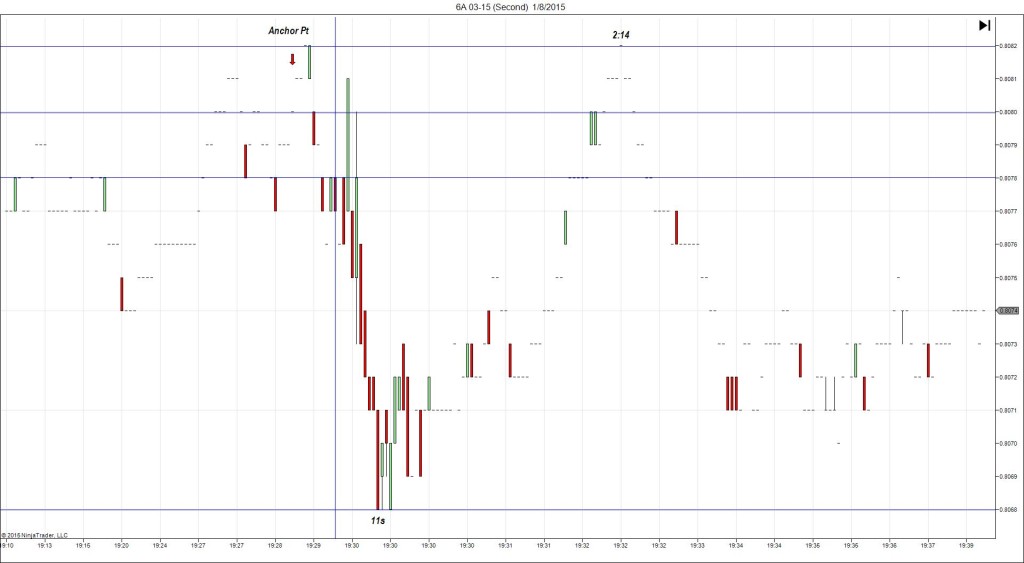

TRAP TRADE – OUTER TIER (NEAR BREAKEVEN EXIT)

Anchor Point @ 0.8048 – shift to 0.8051 (on the 200/100 SMAs)

————

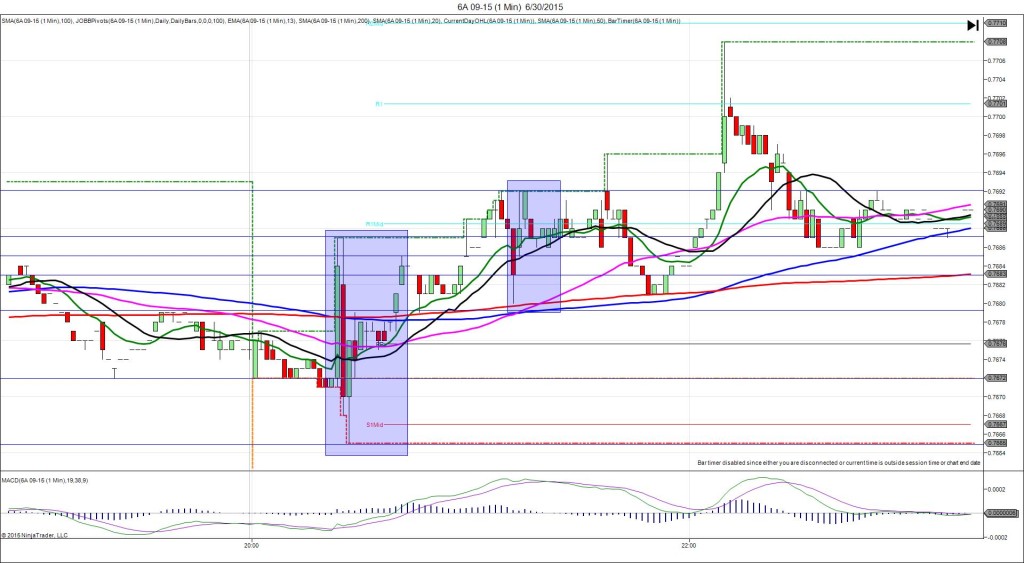

Trap Trade:

)))1st Peak @ 0.8073 – 1930:31 (1 min)

)))22 ticks

)))Reversal to 0.8061 – 1930:47 (1 min)

)))-12 ticks

————

2nd Peak @ 0.8078 – 1933 (3 min)

30 ticks

Reversal to 0.8062 – 1949 (19 min)

16 ticks

Final Peak @ 0.8083 – 2000 (30 min)

35 ticks

Reversal to 0.8067 – 2031 (61 min)

16 ticks

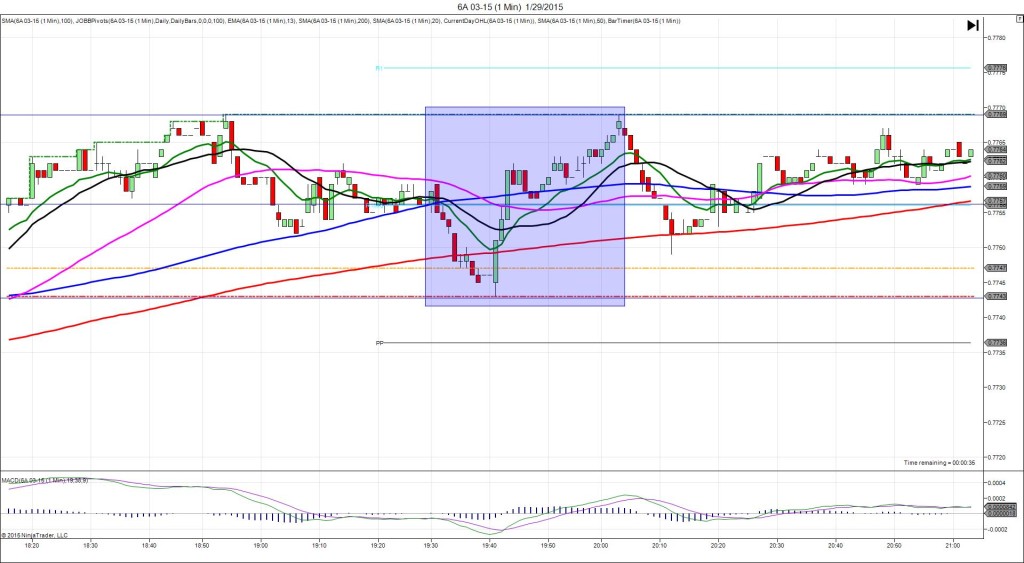

Trap Trade Bracket setup:

Long entries – 0.8043 (on the LOD) / 0.8036 (No SMA / Pivot near)

Short entries – 0.8059 (just above the R1 Mid Pivot) / 0.8067 (just above the R1 Pivot)

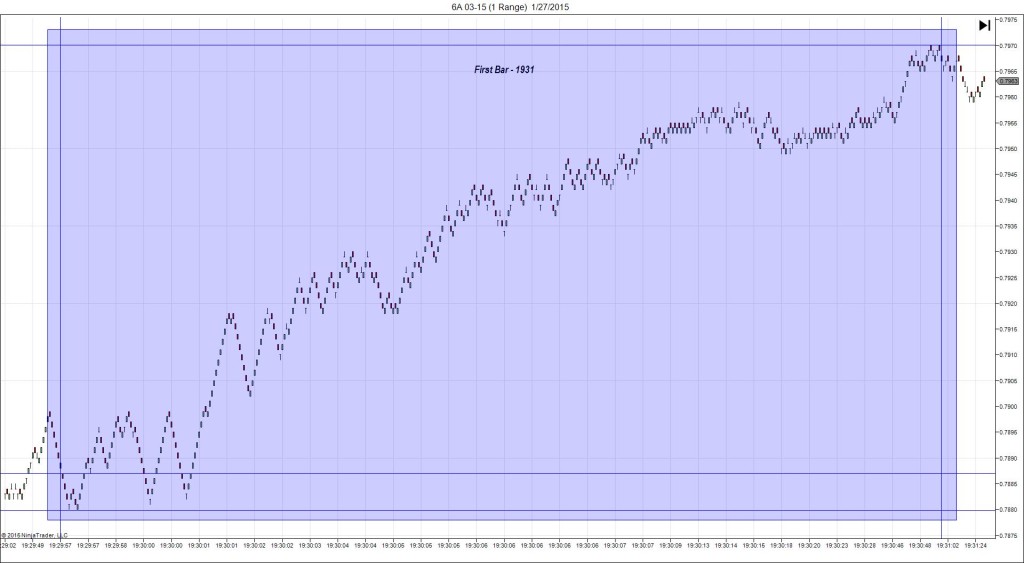

Notes: Report strongly exceeded the forecast with a large upward revision to the previous report. This caused a long spike of 22 ticks in 31 sec that crossed the R1 Pivot and nearly reached the R2 Mid Pivot while extending the HOD. As the price drifted upward about 3 ticks in the 45 sec before the report, bias your brackets higher. This would have filled both of your short entries for an average entry of 0.8063 then gone up to 10 ticks in the red from the combined position before reversing to allow 1-2 ticks of profit near the area of the HOD position. Look to exit there. After that it stepped higher for a 2nd peak of 8 more ticks in 2 min before reversing 16 ticks in 16 min. Then it climbed for a final peak of 5 more ticks in 11 min before reversing 16 ticks in 31 min.