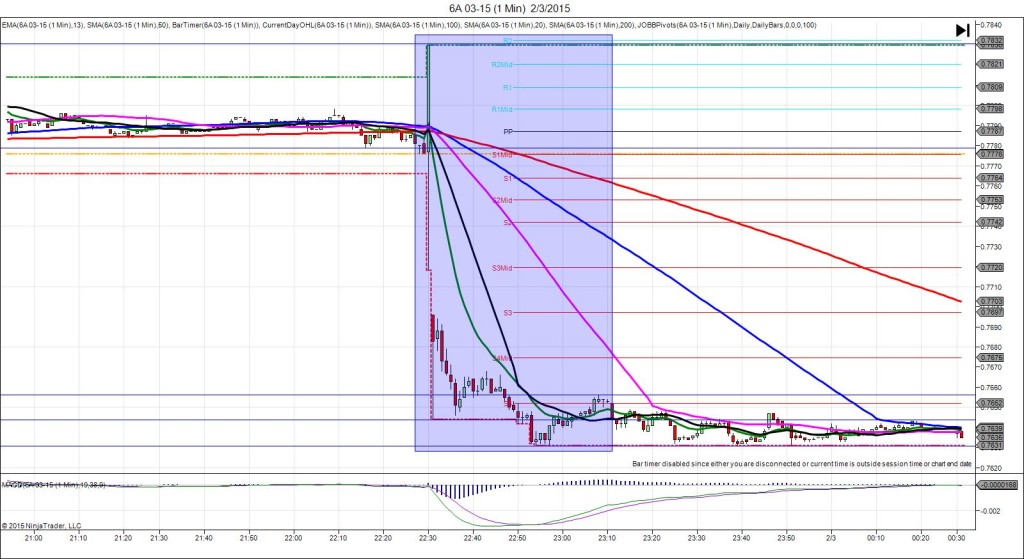

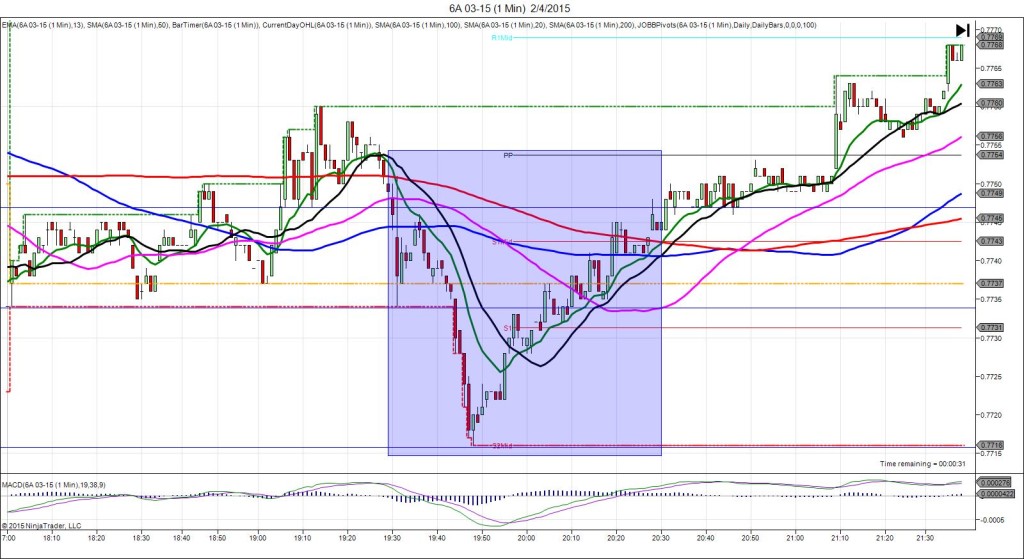

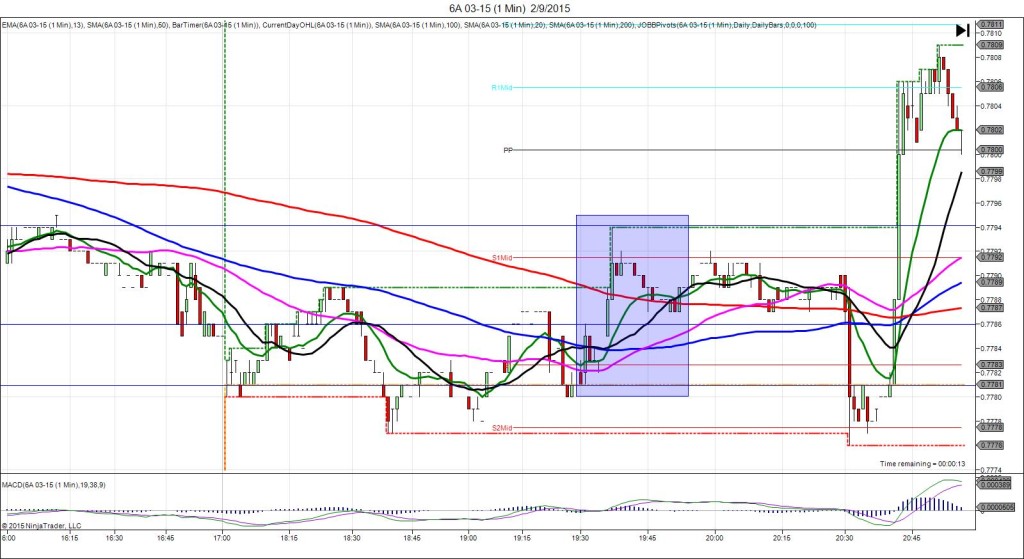

11/26/2014 Quarterly Private Capital Expenditure (1930 EST)

Forecast: -1.7%

Actual: 0.2%

Previous Revision: +0.5% to 1.6%

SPIKE / REVERSE

Started @ 0.8525

1st Peak@ 0.8550 – 1930:49 (1 min)

25 ticks

Reversal to 0.8539 – 1933 (3 min)

11 ticks

2nd Peak @ 0.8557 – 1942 (12 min)

32 ticks

Reversal to 0.8535 – 2001 (31 min)

22 ticks

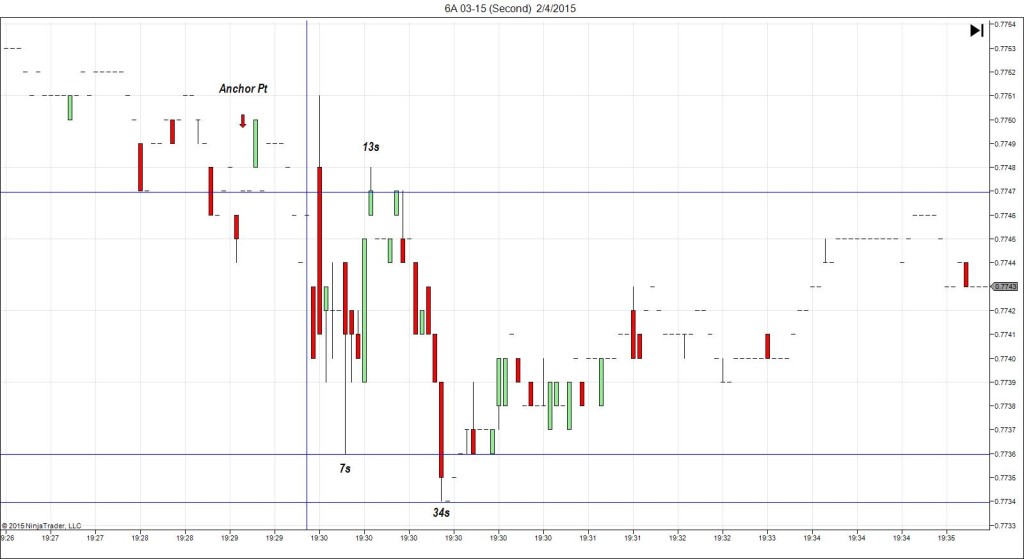

Notes: Report exceeded the forecast by 1.9% along with a 0.5% upward revision to the previous report. This caused a long spike of 25 ticks that started on the PP Pivot and rose to hit and stall at the 200 SMA after 2 sec, then resume climbing to cross the R1 Mid Pivot just before the :31 bar expired. With JOBB and a 4 tick bracket, your long order would have filled with 3 ticks of slippage at 0.8532. You would have seen it stall on the 200 SMA for only 4 sec, but be patient as the result and previous revision are consistent and the size of the spike at 10 ticks was very small compared to the average. Sure enough, it climbed another 15 ticks as the bar neared expiration to allow up to 17 ticks to be captured. Then it reversed 11 ticks in 2 min to the R1 Mid Pivot before climbing for a 2nd peak of 7 more ticks in 9 min to nearly reach the R1 Pivot. After that it reversed 22 ticks to the 200 SMA in 19 min.