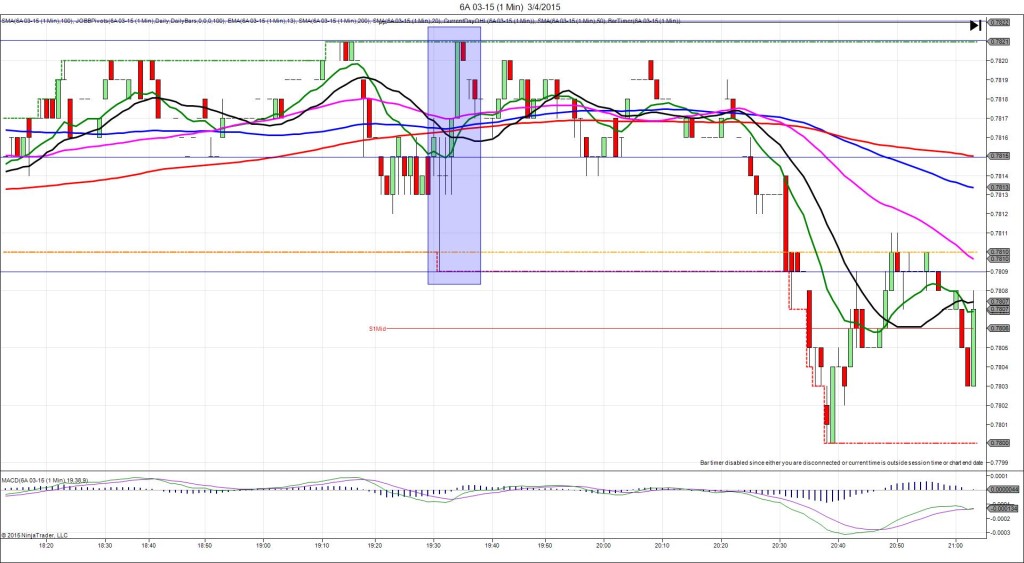

3/2/2015 RBA Rate Statement / Cash Rate (2230 EST)

Forecast: 2.00%

Actual: 2.25%

TRAP TRADE – INNER TIER STOPPED

Anchor point @ 0.7770

————

Trap Trade:

)))1st Peak @ 0.7821 – 2229:25 (0 min)

)))51 ticks

)))Reversal to 0.7790 – 2229:39 (0 min)

)))-31 ticks

)))Pullback to 0.7850 – 2230:01 (1 min)

)))60 ticks

)))Reversal to 0.7802 – 2231:11 (2 min)

)))-48 ticks

————

Pullback to 0.7821 – 2234 (4 min)

19 ticks

Reversal to 0.7791 – 2246 (16 min)

30 ticks

Pullback to 0.7825 – 2312 (42 min)

34 ticks

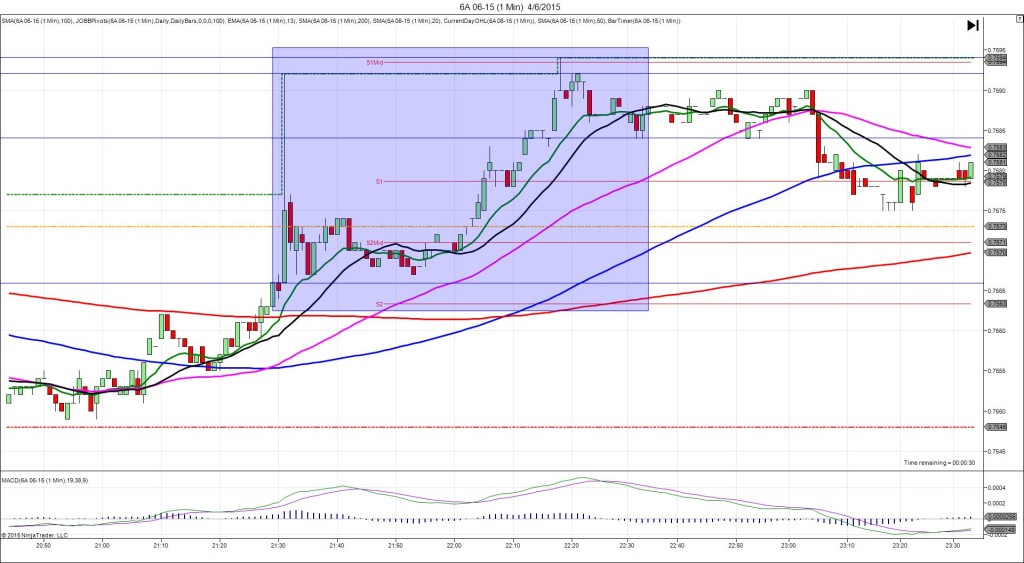

Trap Trade Bracket setup:

Long entry – 0.7743 (just below the S2 Pivot / LOD)

Short entry – 0.7800 (on the R3 Mid Pivot)

Notes: Fresh after a surprise 25 BP rate cut last month, Australia’s central bank was expected to cut rates by another 25 BP but took everyone by surprise as they left rates unchanged. This caused a premature and very large long spike of 51 ticks about 35 sec early that reached the R4 Mid Pivot. We did anticipate this scenario, but underestimated the size of the spike by about 15 ticks. With JOBB and a single tier of about 30 ticks, you would have been filled with the short entry around 0.7800, then stopped 1 sec later at 0.7815 with 15 ticks loss. Then it reversed 31 ticks in the next 14 sec and chopped sideways in between the R2 and R3 Mid Pivots until the new bar where it spiked long for another 60 ticks in 1 sec to eclipse the R4 Pivot. Then it reversed 48 ticks in the next 70 sec to the R3 Mid Pivot. After that it pulled back 19 ticks in 2 min to the R4 Mid Pivot before reversing 30 ticks in 12 min to nearly reach the R2 Pivot. Then it pulled back 34 ticks in 26 min to the R4 mid Pivot and traded sideways.