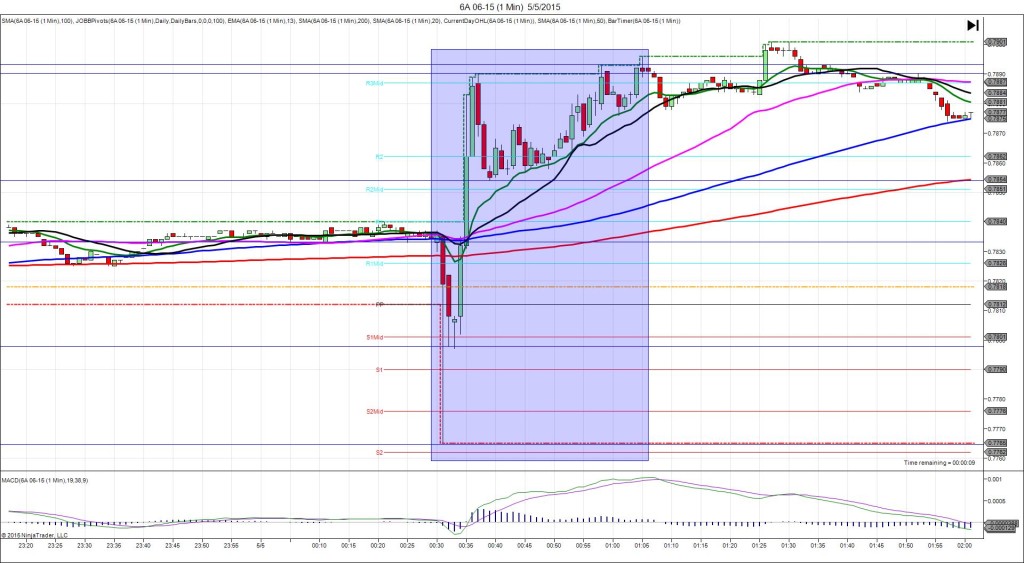

4/15/2015 Monthly Unemployment Report (2130 EDT)

Employment Change Forecast: 14.9K

Employment Change Actual: 37.7K

Previous Revision: +26.4K to 42.0K

Rate Forecast: 6.3%

Rate Actual: 6.1%

Previous Revision: -0.1% to 6.3%

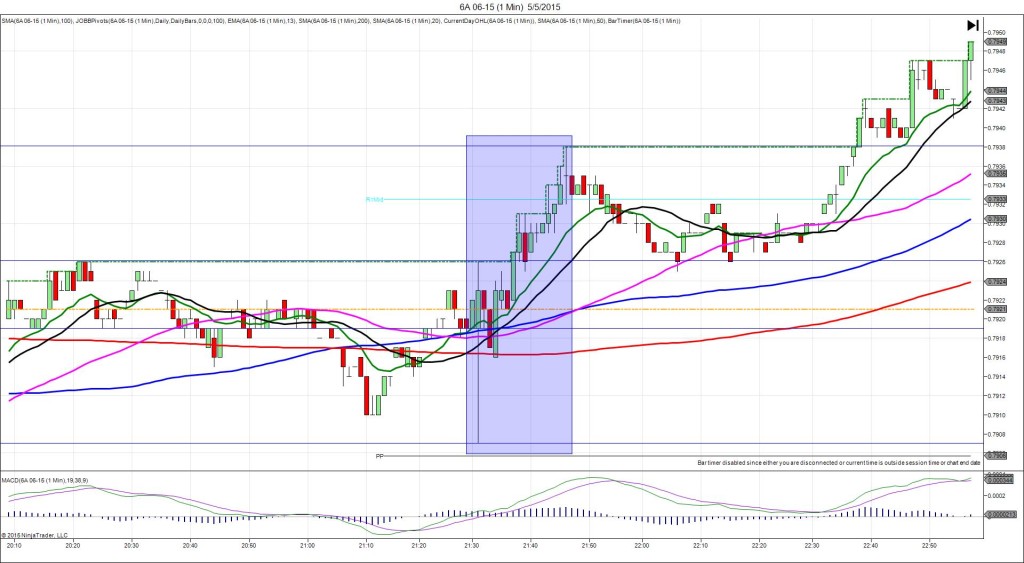

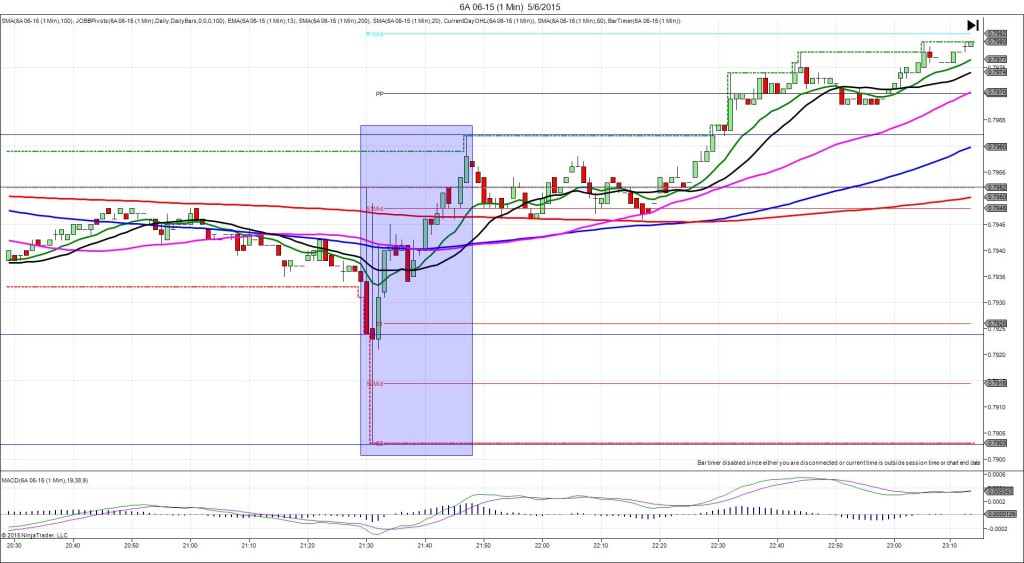

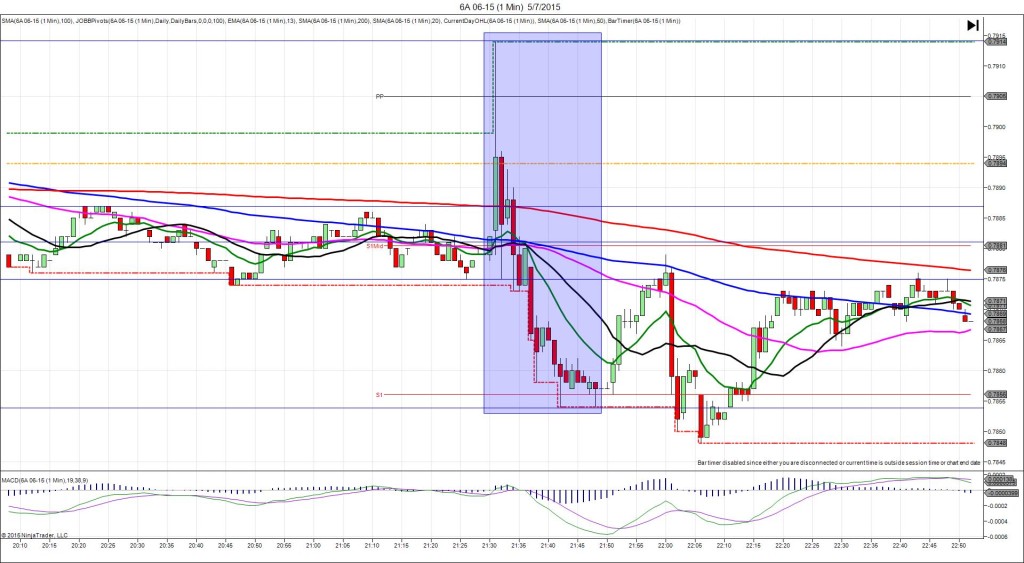

SPIKE WITH 2ND PEAK

Started @ 0.7693

1st Peak @ 0.7750 – 2131:15 (2 min)

57 ticks

Reversal to 0.7740 – 2135 (5 min)

10 ticks

2nd Peak @ 0.7758 – 2141 (11 min)

65 ticks

Reversal to 0.7732 – 2001 (31 min)

26 ticks

Notes: Very broadly strong report with 22.8k more jobs created than the forecast with a 0.2% drop in the rate while the previous report was revised strongly better. This caused an immediate 49 tick long spike that retraced about 40 ticks. This is where our settings would have come in handy. Your long entry would have been slipped initially due to exceeding 12 ticks of slippage. Then your order would have been filled on the retracement long at about 0.7710. Then it continued to trickle upward until it hovered around the R2 Pivot. This would have allowed up to 40 ticks to be captured. After that it reversed 10 ticks in 3 min before climbing for a minor 2nd peak of 8 more ticks in 6 min. Then it reversed 26 ticks in 20 min after crossing the 50 SMA. Then it traded sideways and drifted a little lower as volume dried up.