12/2/2013 RBA Rate Statement / Cash Rate (2230 EST)

Forecast: 2.50%

Actual: 2.50%

TRAP TRADE (INDECISIVE)

Started @ 0.9079

————

Trap Trade:

)))1st Peak @ 0.9089 – 2230:00 (1 min)

)))10 ticks

)))Reversal to 0.9059 – 2230:33 (1 min)

)))-30 ticks

)))Pullback to 0.9086 – 2232:17 (3 min)

)))27 ticks

————

Reversal to 0.9066 – 2238 (8 min)

20 ticks

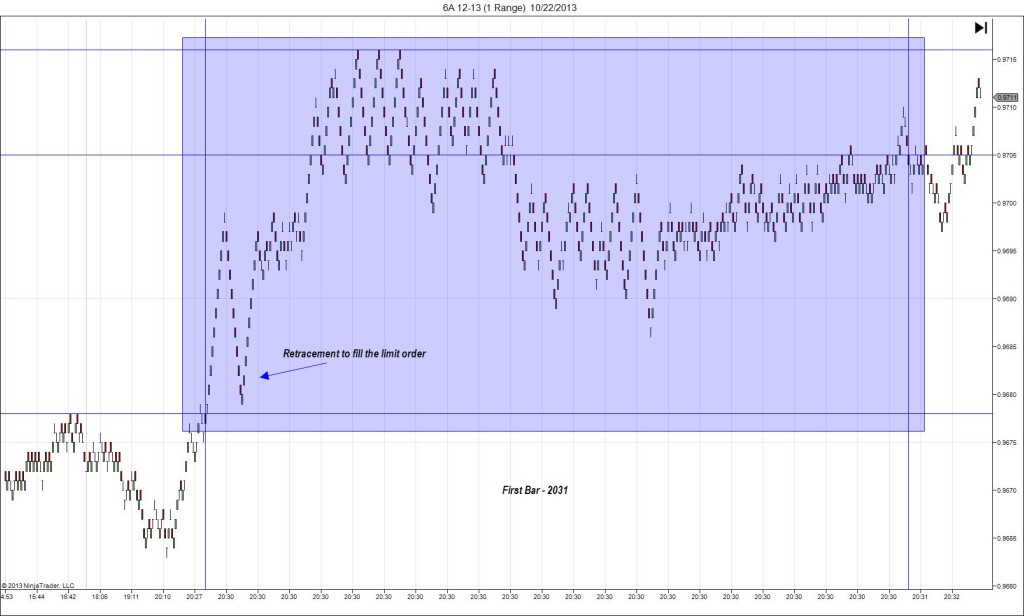

Notes: Australia’s central bank left rates unchanged as expected. This caused an indecisive reaction overall, with swings between the S1 Pivot on the short side and the S1 Mid Pivot / 200 SMA on the long side. Fortunately, indecision is ideal for the Trap Trade, but the move was relatively tame. A trap bracket of 15-25 ticks would use the area below the S1 Pivot at about 0.9061 as the long entry and the OOD at 0.9096 as the short entry. The volatility started early, but use the 20/13 SMAs at 0.9079 as an anchor point. The initial burst long for only 10 ticks was too small and brief to allow an entry, but the fall to 0.9059 would have given an ideal long entry allowing up to 20+ ticks to be captured with a target just above the 100 SMA on the :33 bar. After that it reversed back to 0.9066 5 min later to the S1 Pivot, before rallying up to the 200 SMA and S1 Mid Pivot to continue the oscillating trend. After that it continued to oscillate around the 50/100 SMAs, then fell an hour after the report.