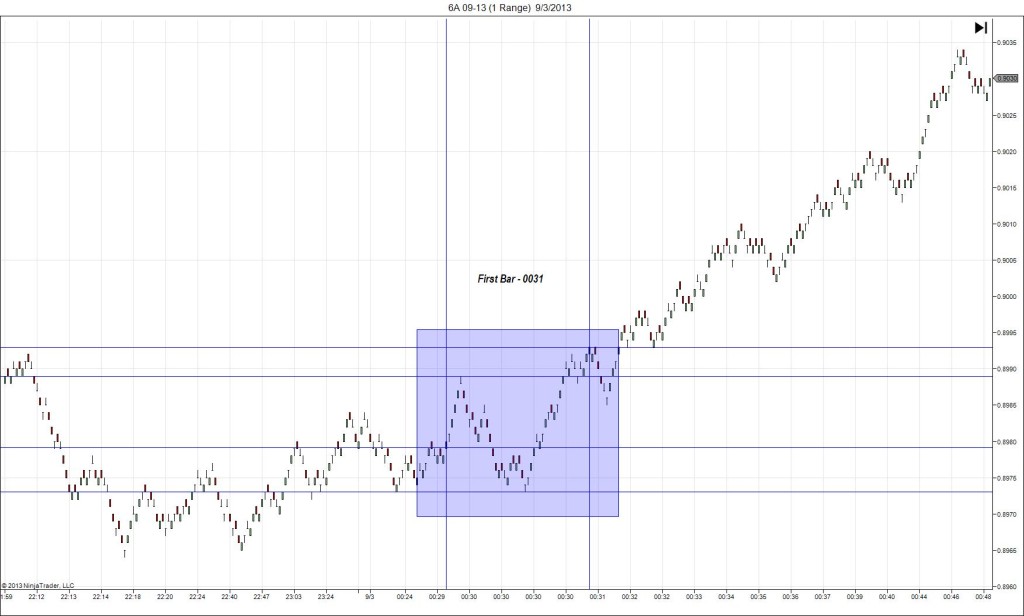

9/3/2013 RBA Rate Statement / Cash Rate (0030 EDT)

Forecast: 2.50%

Actual: 2.50%

TRAP TRADE

Started @ 0.8976

Trap Trade:

1st Peak @ 0.8989 – 0030:01 (1 min)

13 ticks

Reversal to 0.8973 – 0030:36 (1 min)

-16 ticks

Pullback to 0.8993 – 0031:06 (2 min)

20 ticks

Final Peak @ 0.9041 – 0114 (44 min)

65 ticks

Reversal to 0.9023 – 0156 (86 min)

18 ticks

Notes: Australia’s central bank left rates unchanged as expected 1 month after an expected cut of 25 BP, citing global growth running below average, but inflation well contained, and reasonable prospects of greater growth next year. This testimony was embraced by the market to cause a stable rally. The subtle moves initially would not have been large enough to trigger a trap trade bracket of 20 ticks as the market did not exceed 20 ticks from the appx anchor point of 0.8976 until the :33 bar. With the relatively tame volatility in the initial minute, cancel the trade and do not wait for it to fill. Also, when it does not go short in equal magnitude to the long move, the bias is bullish and not good for the Trap scenario. It turned into a FAN that resulted in 65 ticks attained in 44 min as it crossed the R3 Pivot, then the market sustained the rally and only reversed for 18 ticks in the next 40 min back to the 100 SMA.