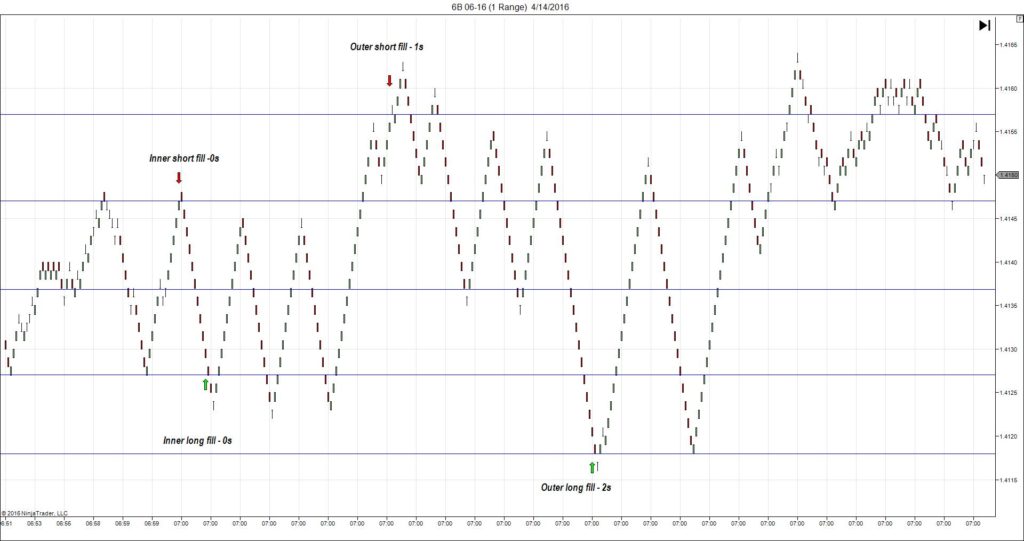

4/14/2016 Official Bank Rate / Asset Purchase Facility (0700 EDT)

Forecast: 0.50%

Actual: 0.50%

TRAP TRADE – OUTER TIER

Anchor Pt @ 1.4137

————

Trap Trade:

)))Whipsaw between 1.4163 and 1.4116 – 0700:02

)))+26 / -21 ticks

)))1st Peak @ 1.4171 – 0701:11 (1 min)

)))34 ticks

————

Reversal to 1.4145 – 0708 (8 min)

26 ticks

Pullback to 1.4165 – 0709 (9 min)

20 ticks

Reversal to 1.4139 – 0716 (16 min)

26 ticks

Trap Trade Bracket setup:

Long entries – 1.4127 (just above the S3 Mid Pivot) / 1.4118 (No SMA / Pivot near)

Short entries – 1.4147 (just below the 100 SMA) / 1.4157 (just below the S2 Pivot)

Expected Fill: All tiers – avg short 1.4152

Best Initial Exit: 1.4122.5 – avg long – 59 ticks

Recommended Profit Target placement: n/a

Notes: As long as your anchor point was with 3 ticks of 1.4137, this would have been an instantaneous profit of almost 60 ticks with the huge whipsaw at launch. After that it peaked at the S2 Mid Pivot then reversed. Another cycle followed then volatility died down.