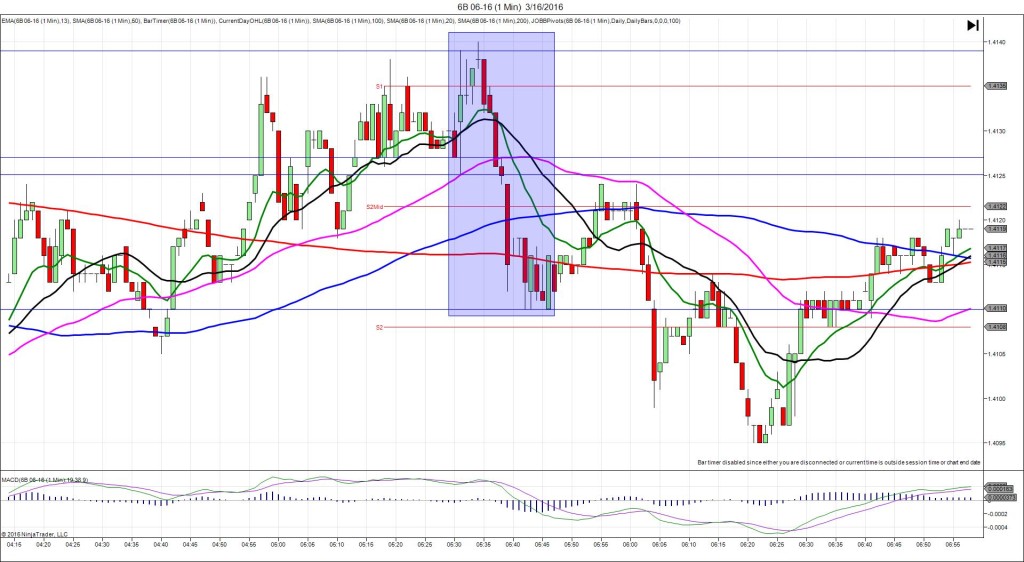

3/16/2016 Average Earnings Index / Claimant Count Change (0530 EDT)

Avg Earnings Index Forecast: 2.0%

Avg Earnings Index Actual: 2.1%

Previous Revision: n/a

Claimant Count Change Forecast: -8.8K

Claimant Count Change Actual: -18.0K

Previous Revision: -13.6K to -28.4K

DULL NO FILL

Started @ 1.4127

1st Peak @ 1.4139 – 0530:31 (1 min)

12 ticks

Reversal to 1.4128 – 0530:35 (1 min)

11 ticks

Pullback to 1.4140 – 0534 (4 min)

12 ticks

Reversal to 1.4110 – 0542 (12 min)

30 ticks

Expected Fill: n/a – cancel

Slippage: n/a

Best Initial Exit: n/a

Recommended Profit Target placement: n/a

Notes: The initial second movement would have been contained within the 10 tick bracket for the first 25 sec, so cancel the order. After dealing with resistance from the S1 Pivot for the first 4 min it reversed nicely for 30 ticks to the 200 SMA.