2/18/2014 Monthly Core CPI / CPI Report (0430 EST)

CPI y/y Forecast: 2.0%

CPI y/y Actual: 1.9%

Previous Revision: n/a

PPI Input m/m Forecast: -0.4%

PPI Input m/m Actual: -0.9%

Previous Revision: +0.1% to 0.2%

RPI y/y Forecast: 2.7%

RPI y/y Actual: 2.8%

Previous Revision: n/a

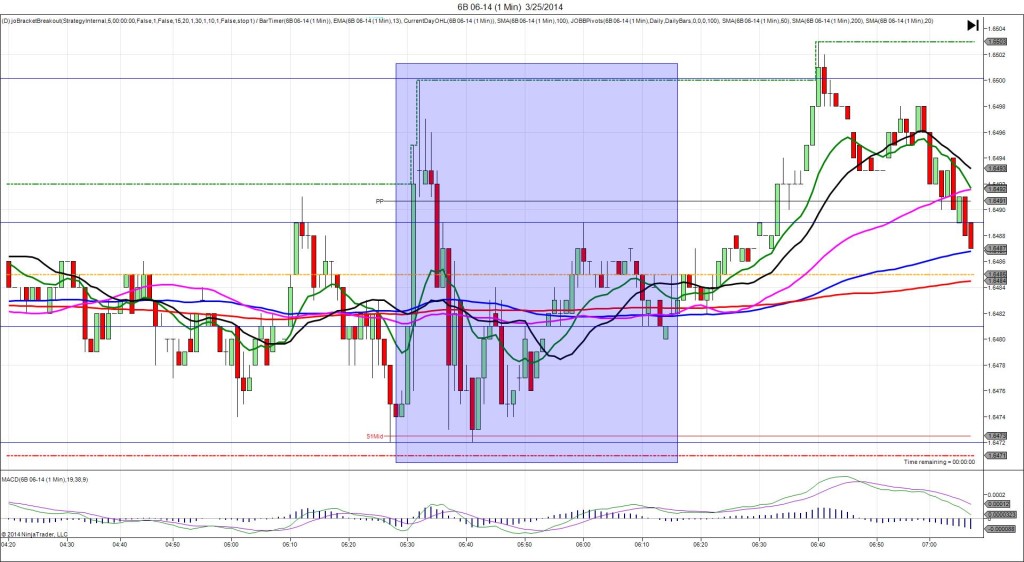

SPIKE WITH 2ND PEAK

Started @ 1.6681

1st Peak @ 1.6655 – 0432 (2 min)

26 ticks

Reversal to 1.6688 – 0439 (9 min)

33 ticks

2nd Peak @ 1.6652 – 0448 (18 min)

29 ticks

Reversal to 1.6705 – 0548 (78 min)

53 ticks

Notes: The CPI report came in 0.1% below the forecast, while the PPI input fell short of the forecast by 0.5%, and the RPI exceeded the forecast by 0.1%. This caused an expected safe short reaction that started on the 50 SMA then fell for 26 ticks, crossing the S2 Pivot and nearly reaching the S3 Mid Pivot. After the :31 bar, it reversed for 33 ticks on the next 8 bars back to the 100 SMA and S1 Pivot. Then it fell for a 2nd peak of 3 more ticks on the :18 bar to the S3 Mid Pivot. After that, it headed into a slow developing reversal for 53 ticks in the next hour, crossing all 3 major SMAs and reaching the PP Pivot.