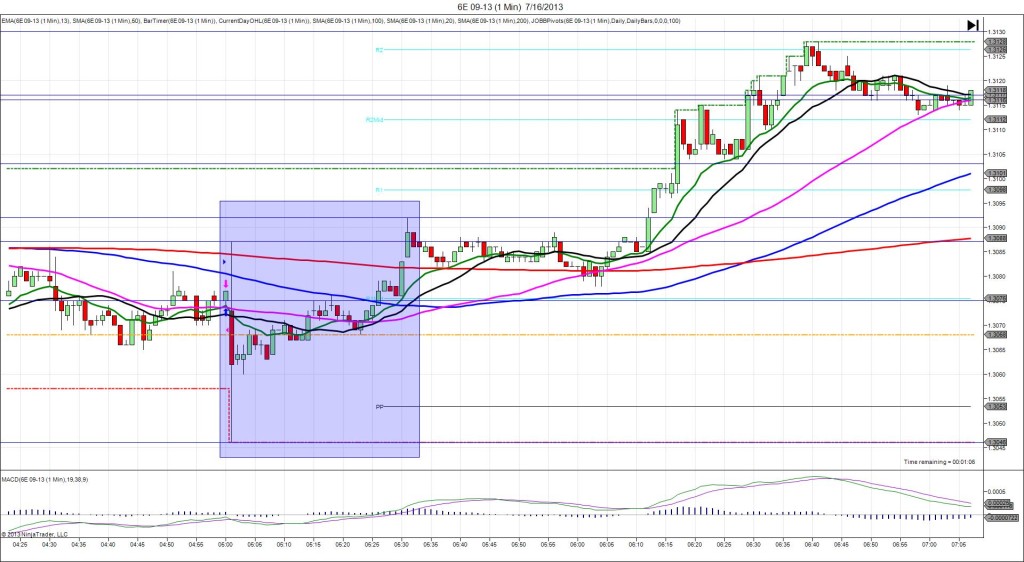

7/16/2013 German ZEW Economic Sentiment (0500 EDT)

Forecast: 39.8

Actual: 36.3

SPIKE/REVERSE

Started @ 1.3075

1st Peak @ 1.3087 – 0501 (1 min)

12 ticks

Reversal to 1.3046 – 0501 (1 min)

-41 ticks

Notes: The reading came in 3.5 points worse than the forecast causing an indecisive reaction. This caused a 12 tick unsustainable long spike on the :01 bar that eclipsed the 200 / 100 SMAs, followed by an immediate reversal of 41 ticks in just 6 seconds that crossed the PP Pivot and extended the LOD. Then it retreated and left 17 ticks on the tail naked. With JOBB you would have filled long at about 1.3083 with 4 ticks of slippage, then stopped at 1.3069 with 4 ticks of slippage on the quick reversal. We will trap trade this report next time due to the shifting trend. After the :01 bar, it trended slightly higher for the next 2 hrs, disregarding the news.

-121112.jpg)

-111312.jpg)

-101612.jpg)