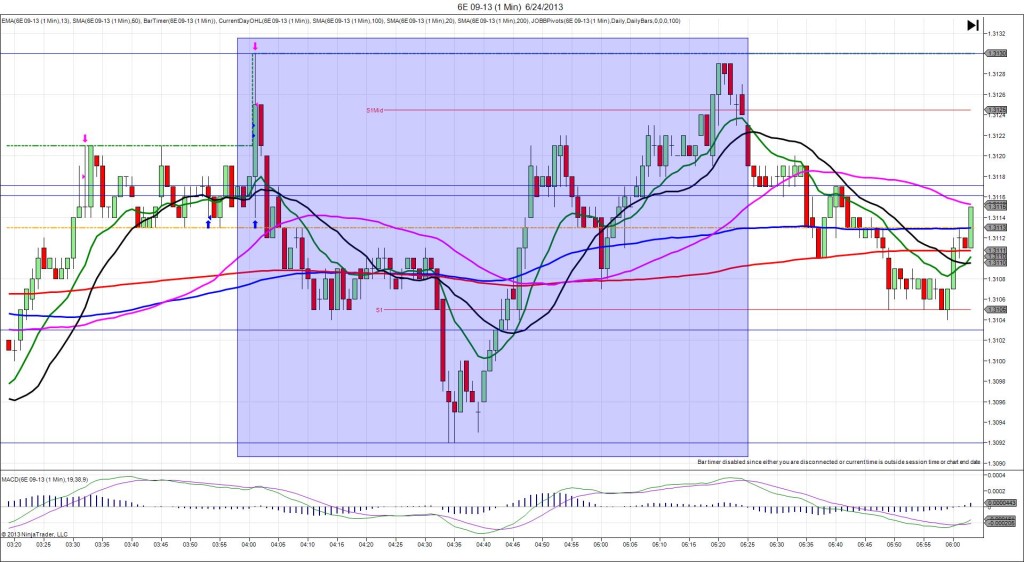

6/24/2013 German IFO Business Climate (0400 EDT)

Forecast: 106.0

Actual: 105.9

Previous Revision: n/a

SPIKE/REVERSE

Started @ 1.3117

1st Peak @ 1.3130 – 0401 (1 min)

13 ticks

Reversal to 1.3092 – 0434 (34 min)

14 ticks

Notes: The reading came in nearly matching to cause a relatively muted reaction. Even with a matching report, it was still a strong reading and rallied long, but was already trading near the HOD, so it eclipsed the S1 Mid Pivot, then fell for the reversal. With JOBB, you would have filled long at about 1.3122 with no slippage. The 10 tick stop would have absorbed the 8 ticks of heat then you could have set a target at the S1 Mid Pivot or just above for about 3-4 ticks that would have filled about 15 sec into the bar. The reversal came down to the S1 Pivot and 100/200 SMAs, then traded sideways for about 25 min before falling another 13 ticks. After that it rallied for a double top, 1 tick short of the original peak.