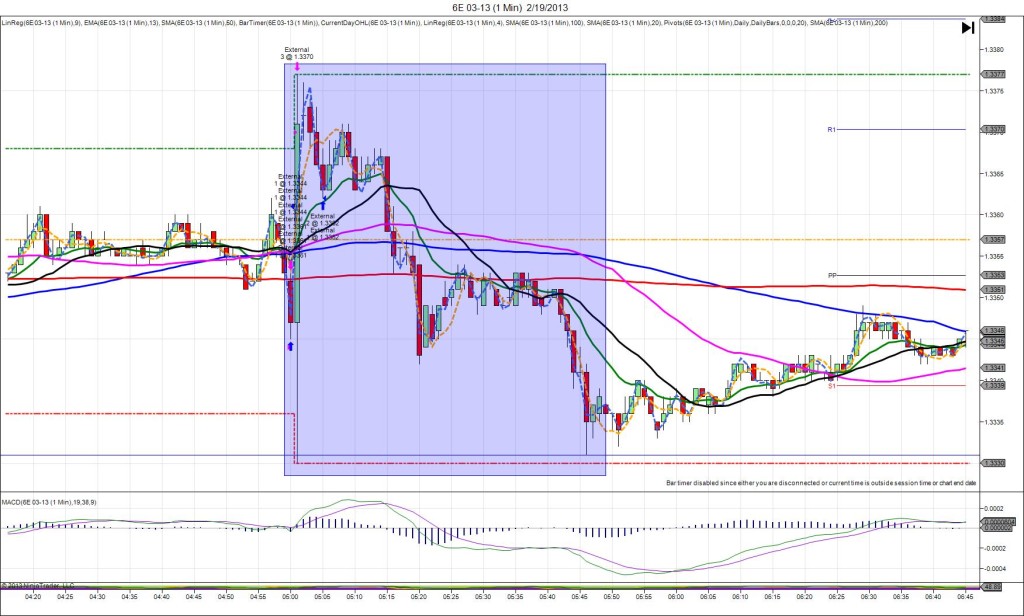

3/19/2013 German ZEW Economic Sentiment (0600 EDT)

Forecast: 47.9

Actual: 48.5

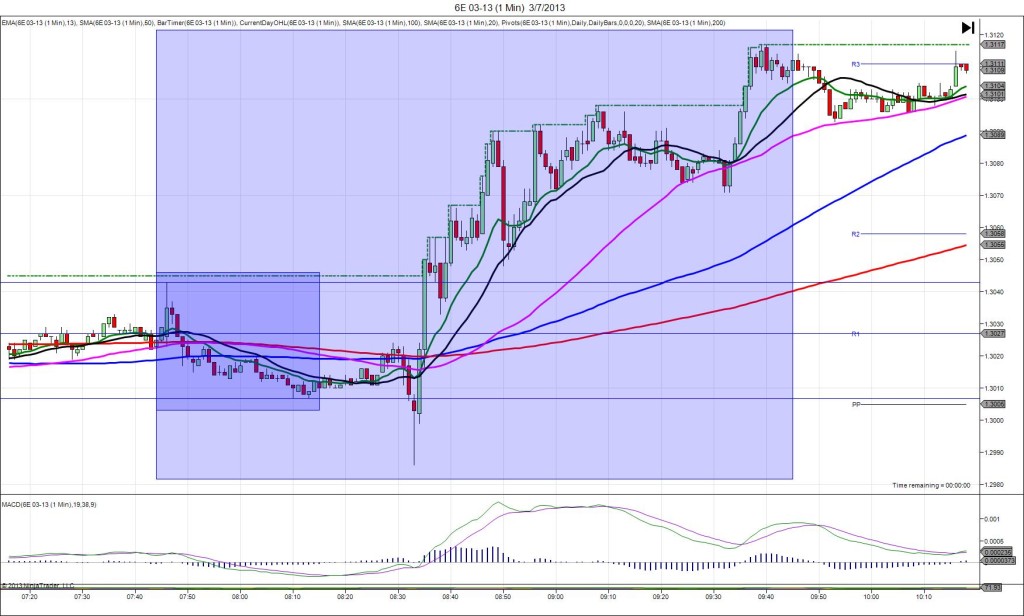

SPIKE/REVERSE

Started @ 1.2947

1st Peak @ 1.2967 – 0601 (1 min)

20 ticks

Reversal to 1.2943 – 0606 (6 min)

24 ticks

Notes: The reading came in a narrow 0.6 points better than the forecast to mildly impress. This caused a 20 tick long spike on 1 bar that crossed the PP Pivot and nearly reached the OOD, but was unsustainable, leaving 11 ticks of the wick naked. With JOBB you would have filled long at about 1.2950 with no slippage. I placed my exit on the PP Pivot and it easily filled for 13 ticks with about 3 ticks to spare. After the spike, it pulled back and quickly reversed for 24 ticks in the next 5 min to cross the 200 SMA. After that it oscillated between 1.2937 and 1.2960 before trending higher about 90 min after the report.