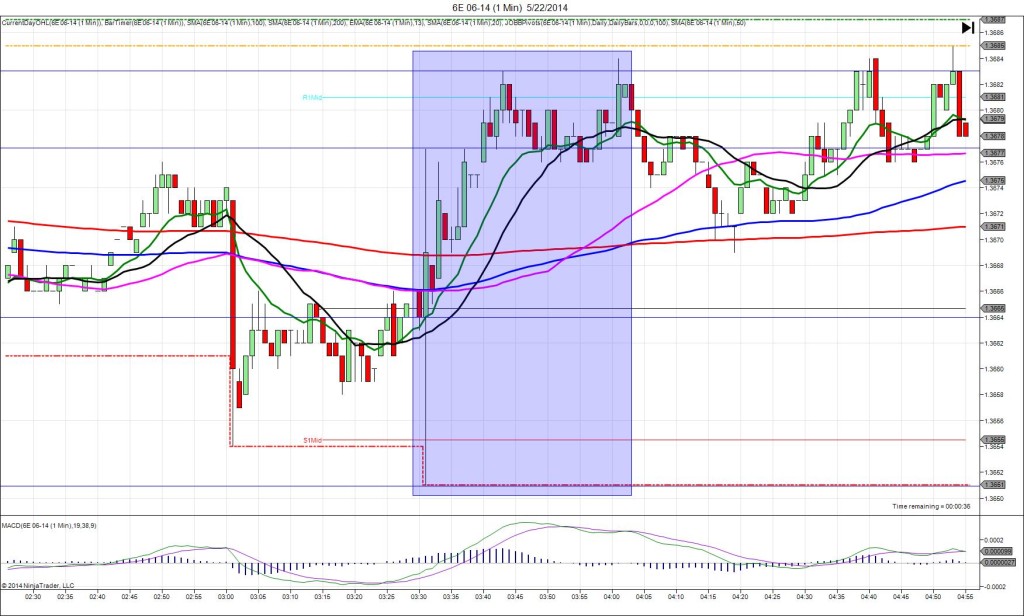

5/22/2014 German Flash Manufacturing PMI (0330 EDT)

Forecast: 54.0

Actual: 52.9

Previous Revision: -0.1 to 54.1

Services PMI

Forecast: 54.8

Actual: 56.4

Previous Revision: -0.3 to 54.7

INDECISIVE

Started @ 1.3664

1st Peak @ 1.3651 – 0331 (1 min)

-13 ticks

Reversal to 1.3677 – 0332 (2 min)

26 ticks

Extended Reversal to 1.3683 – 0343 (13 min)

32 ticks

Notes: The manufacturing reading came in 1.1 points below the forecast to impress with a negligible downward revision on the previous report while the services reading came in 1.6 points above the forecast with a negligible downward previous report revision to cause perfect whipsaw scenario with near equal bias to go short and long to hit the S1 Mid Pivot and LOD on the short side and match the high from 0250 on the long side. With JOBB you would have filled short at about 1.3655 with 5 ticks of slippage, then been stopped at 1.3672 with 2 ticks of slippage for a 7 tick loss. Fortunately this has been the first loss in about 9 months and we can use a tight stop on this report. After the chaotic :31 bar, it extended the reversal to reach the R1 Mid Pivot after 13 min. Then it traded sideways along the 13/20 SMAs and the R1 Mid Pivot.