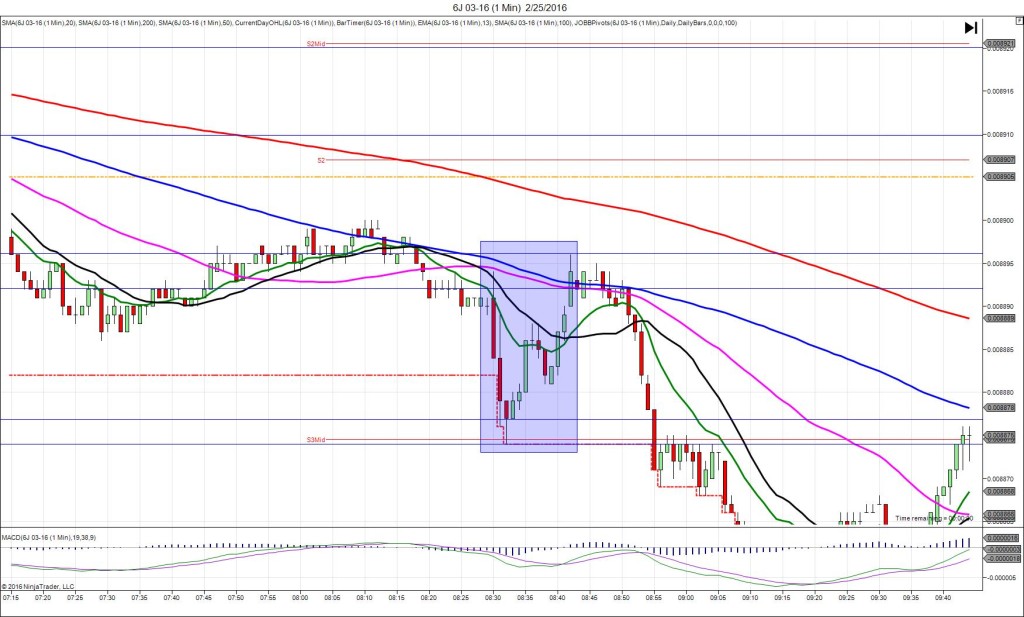

2/25/2016 Monthly Durable Goods Orders (0830 EST)

Core Forecast: 0.2%

Core Actual: 1.8%

Previous revision: +0.2% to -1.0%

Regular Forecast: 3.0%

Regular Actual: 4.9%

Previous Revision: +0.1% to -5.0%

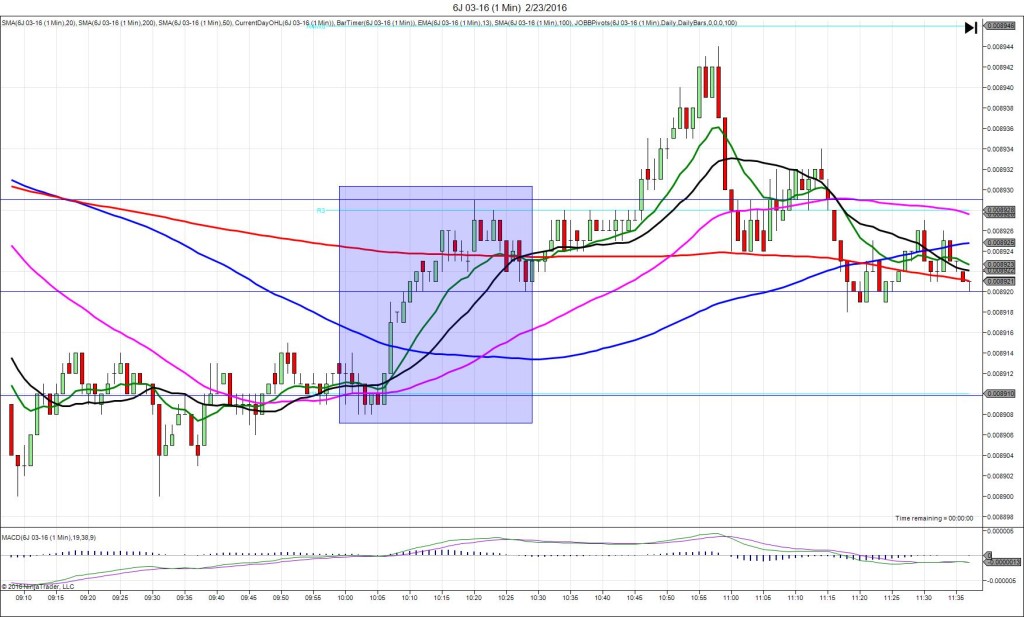

TRAP TRADE – INNER TIER

Anchor Point @ 0.008892

————

Trap Trade:

)))1st Peak @ 0.008877 – 0830:03 (1 min)

)))-15 ticks

)))Hovering around 0.008878

Pullback to 0.008874 – 0831:27 (2 min)

)))-3 ticks

————

Reversal to 0.008888 – 0836 (6 min)

14 ticks

Pullback to 0.008881 – 0838 (8 min)

7 ticks

Reversal to 0.008896 – 0842 (12 min)

15 ticks

Trap Trade Bracket setup:

Long entries – 0.008880 (just below the LOD) / 0.008872 (just below the S3 Mid Pivot)

Short entries – 0.008902 (just below the 200 SMA/OOD) / 0.008909 (just above the S2 Pivot)

Expected Fill: 0.008880 – inner long tier

Best Initial Exit: early conservative exit at 0.008879 – 1 tick loss or move wait for the delayed reversal for 7 ticks at 0.008887.

Recommended Profit Target placement: 0.008899 – move lower

Notes: All aspects of the report were moderately bullish, so it fell decisively for 15 ticks then took 2 min before starting to reverse. Patience would be okay in this scenario as this report still likes to reverse, but the consistent bias of the results kept it near the S3 Mid pivot for a bit.