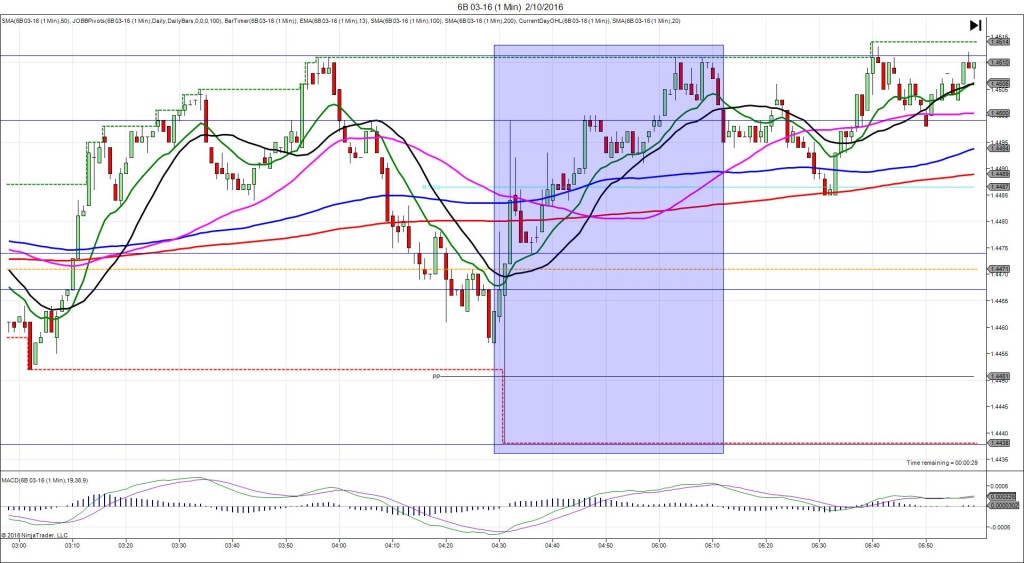

2/19/2016 GBP Retail Sales (0430 EST)

Forecast: 0.8

Actual: 2.3

Previous Revision: -0.4% to -1.4%

TRAP TRADE – DULL NO FILL

Anchor Point @ 1.4328

————

Trap Trade:

)))1st Peak @ 1.4346 – 0430:00 (1 min)

)))18 ticks

)))Reversal to 1.4314 – 0430:07 (1 min)

)))-32 ticks

)))Pullback to 1.4335 – 0431:10 (2 min)

)))21 ticks

————

Reversal to 1.4297 – 0436 (6 min)

38 ticks

Pullback to 1.4309 – 0437 (7 min)

12 ticks

Reversal to 1.4268 – 0442 (12 min)

41 ticks

Pullback to 1.4318 – 0513 (43 min)

50 ticks

Trap Trade Bracket setup:

Long entries – 1.4299 (just above theLOD) / 1.4289 (just below the S1 Pivot)

Short entries – 1.4352 (just above the R1 Mid Pivot) / 1.4366 (just above the R1 Pivot)

Expected Fill: n/a – cancel

Best Initial Exit: n/a

Recommended Profit Target placement: n/a

Notes: Cancel the order as the quick move would have missed the inner short tier by about 6 ticks and ran away quickly. After the strong reversal, it continued to step lower for the next 11 min before pulling back to the area of the market before the report.