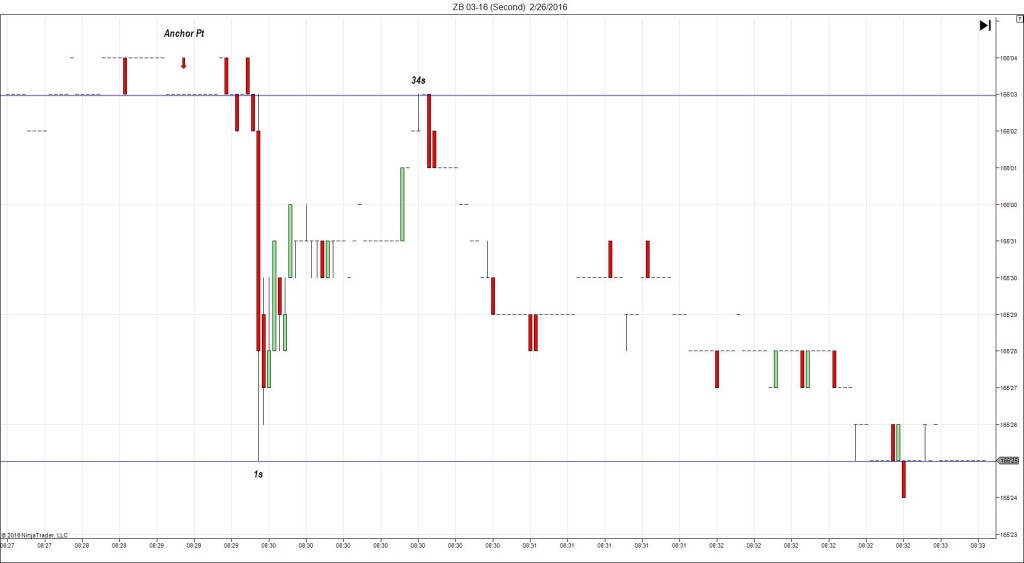

2/26/2015 Quarterly Prelim GDP (0830 EST)

Forecast: 0.4%

Actual: 1.0%

Previous Revision: n/a

TRAP TRADE – OUTER TIER

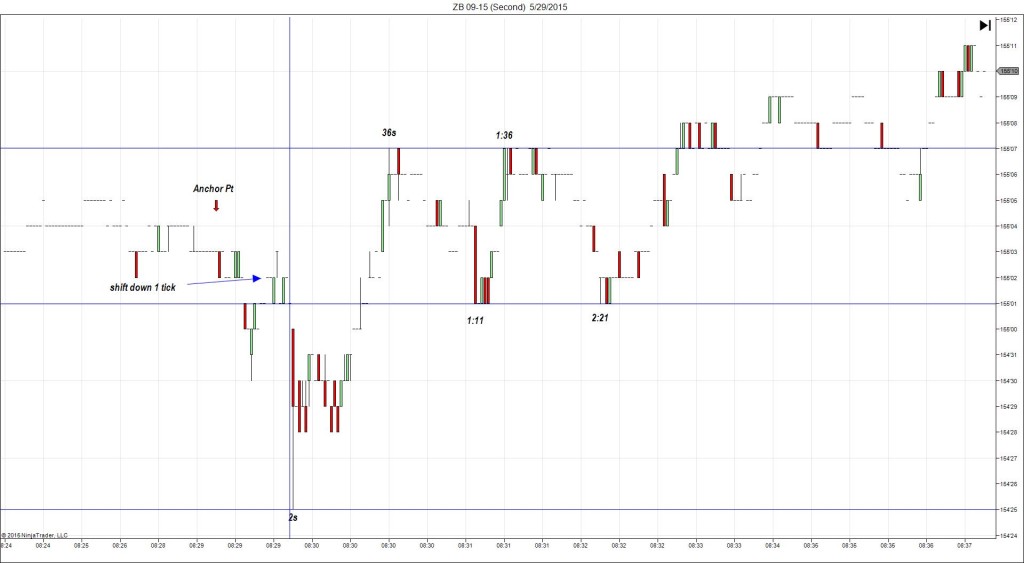

Anchor Point @ 166’03

————

Trap Trade:

)))1st Peak @ 165’25 – 0830:01 (1 min)

)))-10 ticks

)))Reversal to 166’03 – 0830:34 (1 min)

)))10 ticks

————

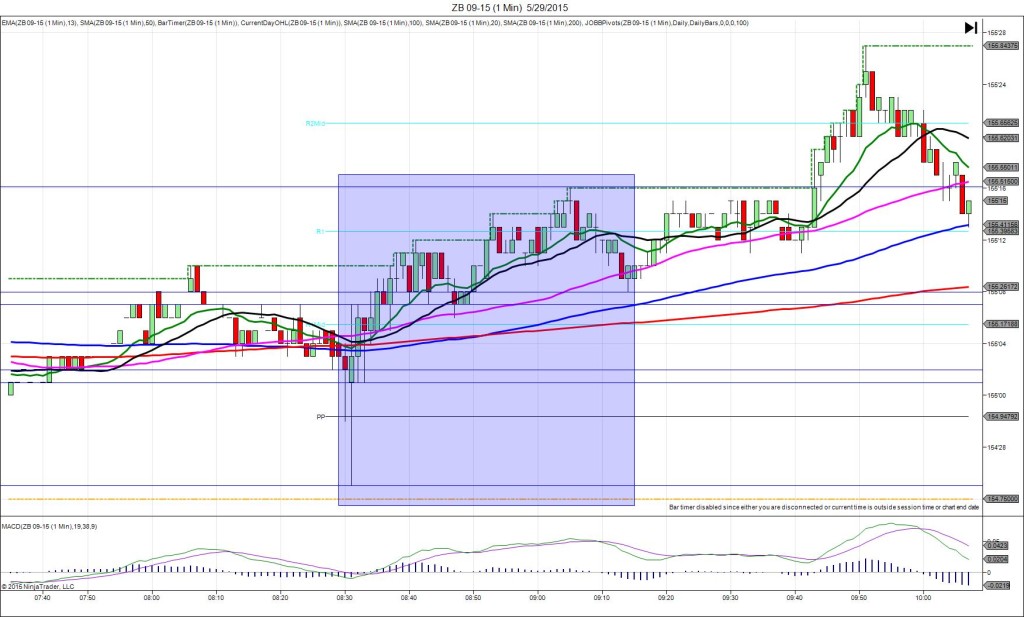

2nd Peak @ 165’14 – 0843 (13 min)

21 ticks

Reversal to 165’26 – 0848 (18 min)

12 ticks

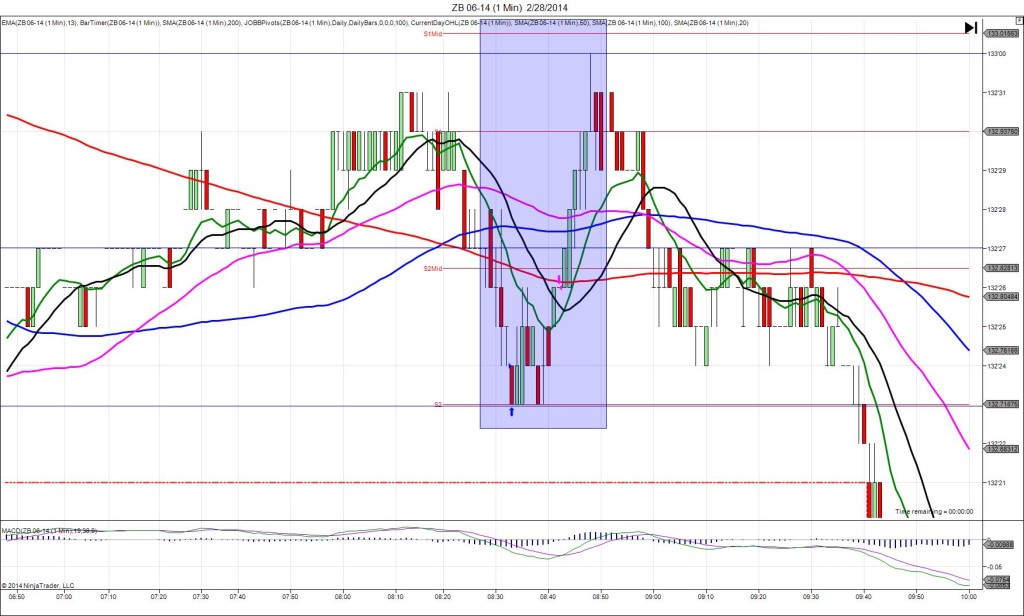

Trap Trade Bracket setup:

Long entries – 165’30 (No SMA / Pivot near)/ 165’27 (above the S2 Mid Pivot)

Short entries – 166’08 (just below the 50 SMA) / 166’11 (in between the 50 and 100 SMAs)

Expected Fill: 165’30 and 165’27 – both long entries

Best Initial Exit: 166’02 – 11 total ticks

Recommended Profit Target placement: 166’03 (just below the S1 Pivot and the origin) – move lower

Notes: Huge offset in context saw an outer tier fill and still large reversal for a good trap trade setup. Be careful here not to linger too long as the overall news is strong and sure to see short follow through after the reversal. We saw a 2nd peak of 11 more ticks in 12 min then a reversal.

-082912.jpg)

-053112.jpg)