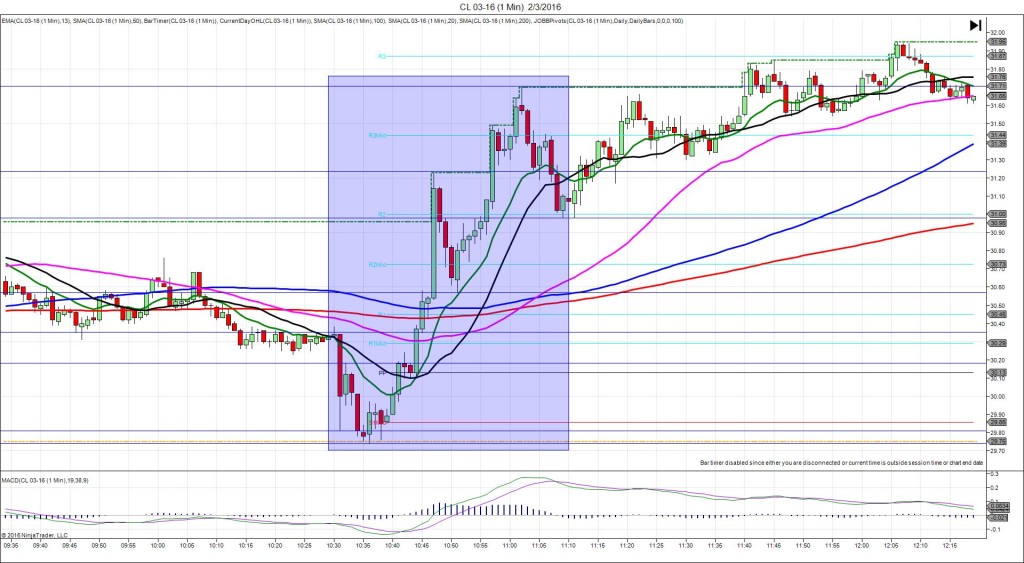

2/3/2016 Weekly Crude Oil Inventory Report (1030 EST)

Forecast: 4.76M

Actual: 7.79M

Gasoline

Forecast: 1.70M

Actual: 5.94M

Distillates

Forecast: -1.10M

Actual: -0.78M

SPIKE WITH 2ND PEAK

Started @ 30.35

1st Peak @ 29.81 – 1030:34 (1 min)

54 ticks

Reversal to 30.18 – 1032 (2 min)

37 ticks

2nd Peak @ 29.74 – 1036 (6 min)

61 ticks

Reversal to 31.23 – 1047 (17 min)

149 ticks

Pullback to 30.57 – 1051 (21 min)

66 ticks

Reversal to 31.70 – 1102 (32 min)

113 ticks

Pullback to 30.98 – 1109 (39 min)

72 ticks

Expected Fill: 30.18 (short)

Slippage: 7 ticks

Best Initial Exit: 29.82 – 36 ticks

Recommended Profit Target placement: 29.85 (just below the S1 Mid Pivot)

Notes: Nice stable short spike on broad based supply sided news. After the small 2nd peak it found support on the OOD and reversed strongly. As it stepped higher, it used the 13/20 SMAs as support.