2/19/2016 Core CPI (0830 EST)

Core Forecast: 0.2%

Core Actual: 0.3%

Previous revision: n/a

Regular Forecast: -0.1%

Regular Actual: 0.0%

Previous Revision: n/a

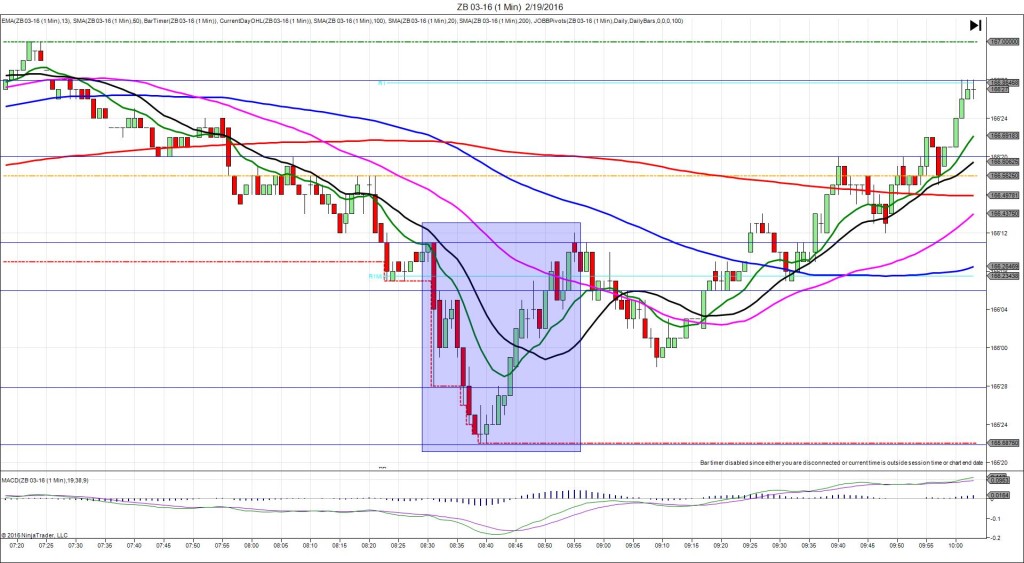

TRAP TRADE – INNER TIER STOPPED

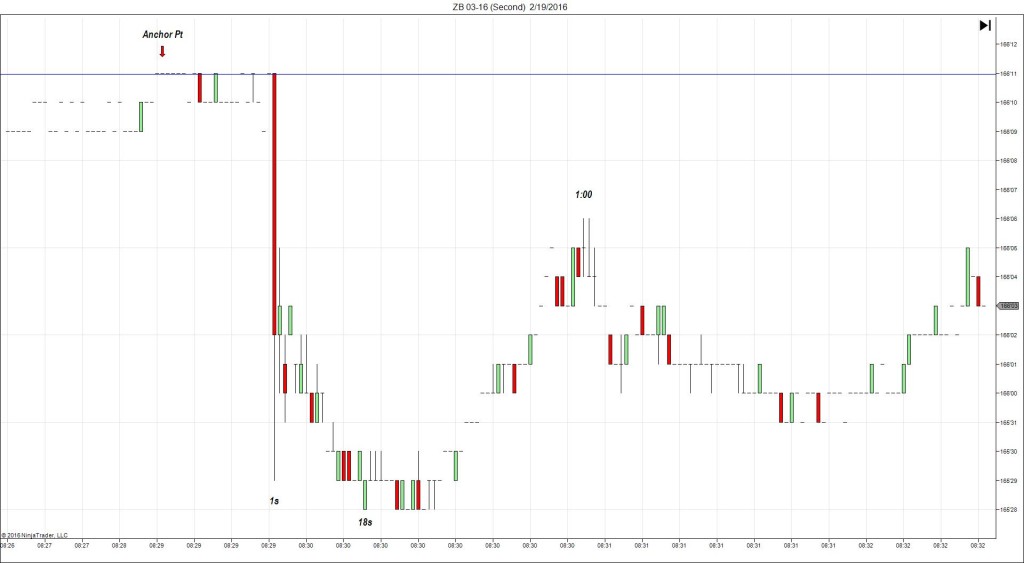

Anchor Point @ 166’11

————

Trap Trade:

)))1st Peak @ 165’28 – 0830:18 (1 min)

)))-15 ticks

)))Reversal to 166’06 – 0831:00 (2 min)

)))10 ticks

————

2nd Peak @ 165’23 – 0839 (9 min)

20 ticks

Reversal to 166’12 – 0855 (25 min)

21 ticks

Trap Trade Bracket setup:

Long entry – 166’05 (just below the R1 Mid Pivot / OOD)

Short entry – 166’18 (on the OOD)

Expected Fill: 166’05 – inner long tier

Best Initial Exit: stopped at 166’00 for 5 tick loss or if stop disabled – 166’05 – Breakeven

Recommended Profit Target placement: n/a

Notes: First reaction we have seen over 9 ticks since the ZB started reacting to this report. The stop may have been disabled do to the speed of the spike. If so, trust the reversal and add a 2nd long position at 165’29 where it hovered before reversing. Then exit at 166’05 where it hovered again. After that it fell for a 2nd peak of 5 more ticks before reversing to eclipse the 50 SMA and R1 Mid Pivot.