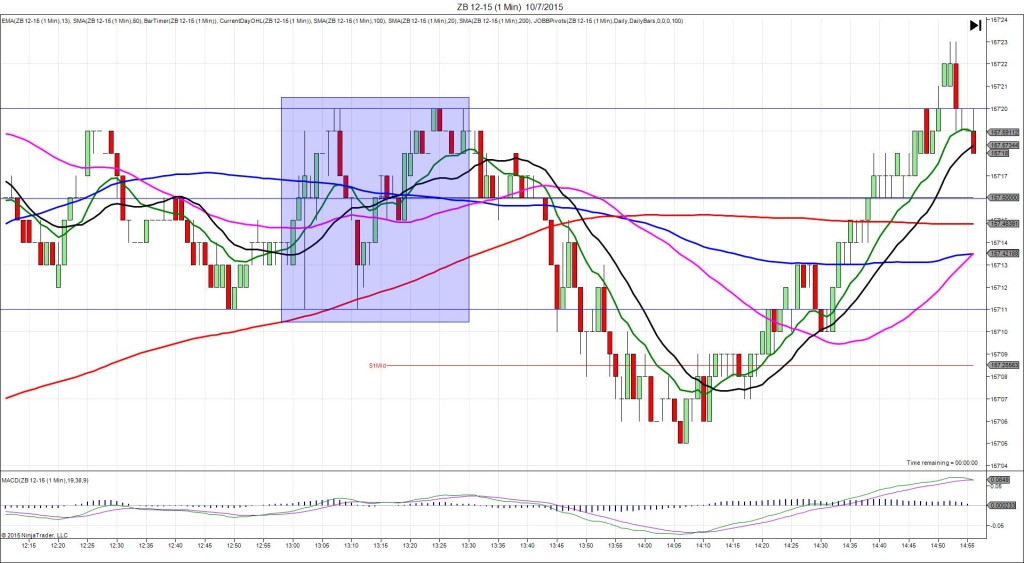

5/13/2015 10-yr Bond Auction (1301 EDT)

Previous: 1.93/2.6

Actual: 2.24/2.7

TRAP TRADE – OUTER TIER DULL FILL

Anchor Point @ 153’02 (1301)

————

Trap Trade:

)))1st Peak @ 152’30 – 1301:36 (1 min)

)))-4 ticks

)))Reversal to 153’14 – 1301:46 (1 min)

)))16 ticks

)))Pullback to 153’08 – 1302:06 (1 min)

)))-6 ticks

————

Reversal to 153’21 – 1307 (6 min)

13 ticks

Pullback to 152’29 – 1323 (22 min)

24 ticks

Trap Trade Bracket setup:

Long entries – 152’30 or 152’29 (on/below the 50 SMA) / 152’27 (just above the 20 SMA)

Short entries – 153’07 (just above the S1 Pivot) / 153’11 (just below the 200 SMA)

Notes: Report is scheduled on Forex Factory at the top of the hour, but the spike always breaks 1:30 – 1:40 late. The highest yield rose considerably from last month’s auction while the bid to cover ratio rose slightly. This caused the ZB to pop short 4 ticks then reverse 16 ticks in 10 sec to the 200 SMA. This would have resulted in 2 possible scenarios. If you placed your inner long entry at 152’30, you may have filled long then had the inner short entry cover the trade for 9 ticks, then the outer short entry fill. The more likely case would have been the inner and outer short entries fill with an average short position at 153’09. As it reversed it hovered at 153’10 to allow an exit with 1 tick loss (2 total ticks with both positions). Then it reversed in a choppy manner to climb 13 ticks to the OOD in 5 min before pulling back 24 ticks in 16 min after crossing the 100/50 SMAs. It continued to swing for another hour then eventually settled lower.