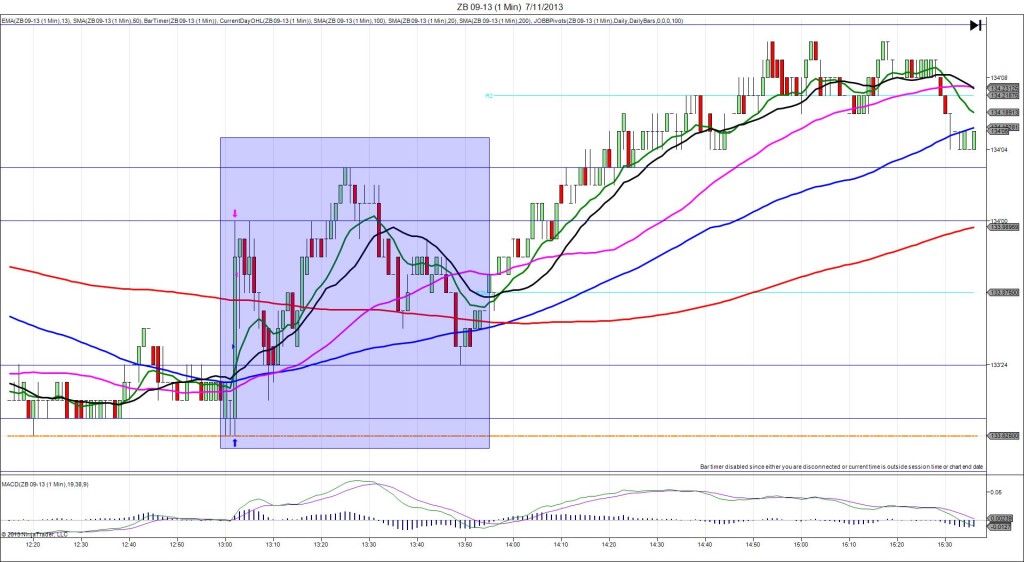

10/10/2013 30-yr Bond Auction (1301 EDT)

Previous: 3.82/2.4

Actual: 3.76/2.6

SPIKE WITH 2ND PEAK

Started @ 132’06 (1301)

1st Peak @ 132’15 – 1302 (1 min)

9 ticks

Reversal to 132’10 – 1304 (3 min)

5 ticks

2nd Peak @ 132’18 – 1307 (6 min)

12 ticks

Reversal to 132’11 – 1312 (11 min)

7 ticks

Final Peak @ 132’23 – 1409 (68 min)

17 ticks

Reversal to 132’18 – 1450 (109 min)

5 ticks

Notes: Report is scheduled on Forex Factory at the bottom of the hour, but the spike always breaks 1 min late. The highest yield fell slightly from last month but still continued the high rise since May as the talk of tapering of QE3 continues to take its toll. Even though the last FED meeting did not result in scaling back the bond buying, the perception is for only a short delay. This caused the bonds to rally for 9 ticks, crossing no major SMAs and the S3 Mid Pivot. With JOBB you would have filled long at 132’12 with 3 ticks of slippage, then had an opportunity to capture about 2 ticks at most on the initial burst. Given the rarity of 2nd peaks in the past few weeks, it would be safe to get out with a modest gain. After the 1st peak, it stepped higher until a final peak of 17 ticks over an hour after the report, crossing the S2 Mid Pivot, then fell a modest 5 ticks and traded sideways just above the S2 Pivot.

-011013.jpg)