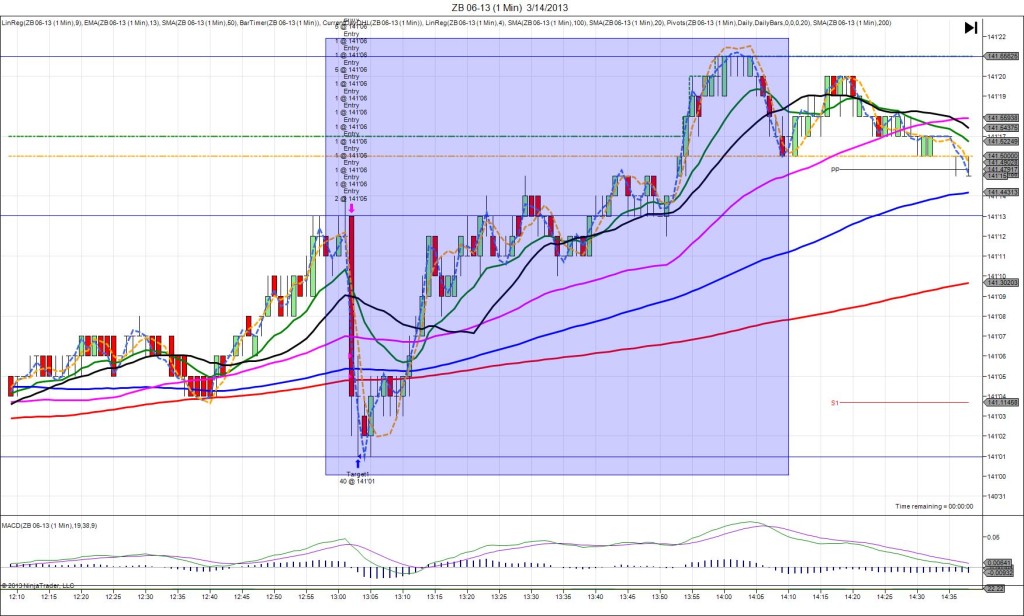

3/14/2013 30-yr Bond Auction (1301 EST)

Previous: 3.18/2.7

Actual: 3.25/2.4

SPIKE/REVERSE

Started @ 141’13 (1301)

1st Peak @ 141’01 – 1303 (2 min)

12 ticks

Reversal to 141’21 – 1359 (58 min)

20 ticks

Notes: Report is scheduled on Forex Factory at the bottom of the hour, but the spike always breaks 1 min late. The highest yield rose slightly after February, 2 months after the FED started to buy $85B in long term bonds each month. This caused a drop of 12 ticks. With JOBB you would have filled short at 141’06 with an abnormally high 4 ticks of slippage. The spike crossed all 3 major SMAs and the S1 Pivot, so it had to contend with a lot of support. Noting the average yield is 13 ticks and the location of the S1 Pivot, I placed my target at 141’01 and was filled with 5 ticks. After 10 min of trading between 141’01 and the 200 SMA, it reversed strongly back to the origin in 5 min, then slowly climbed another 9 ticks, extending the HOD by 4 ticks in another 45 min.