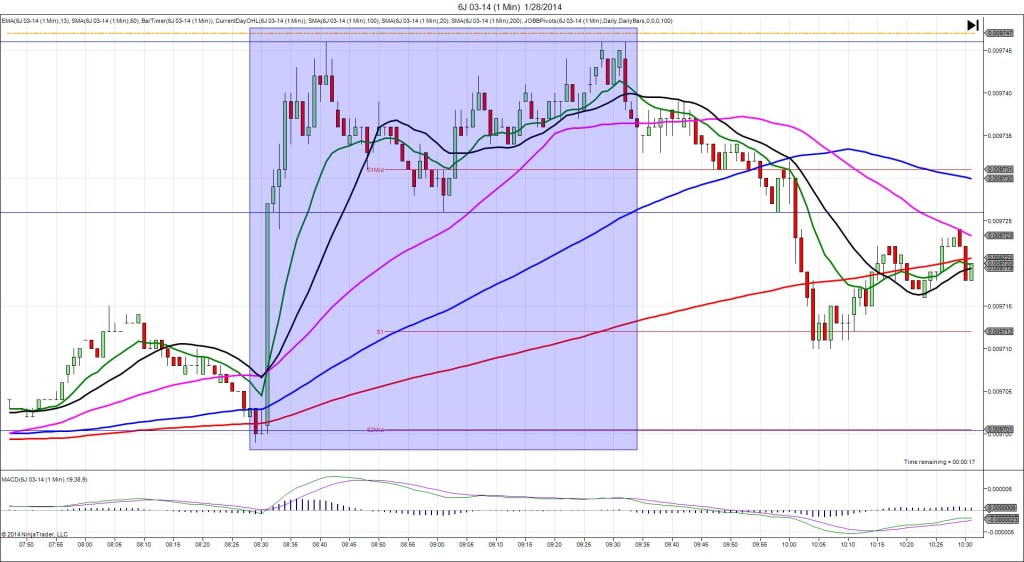

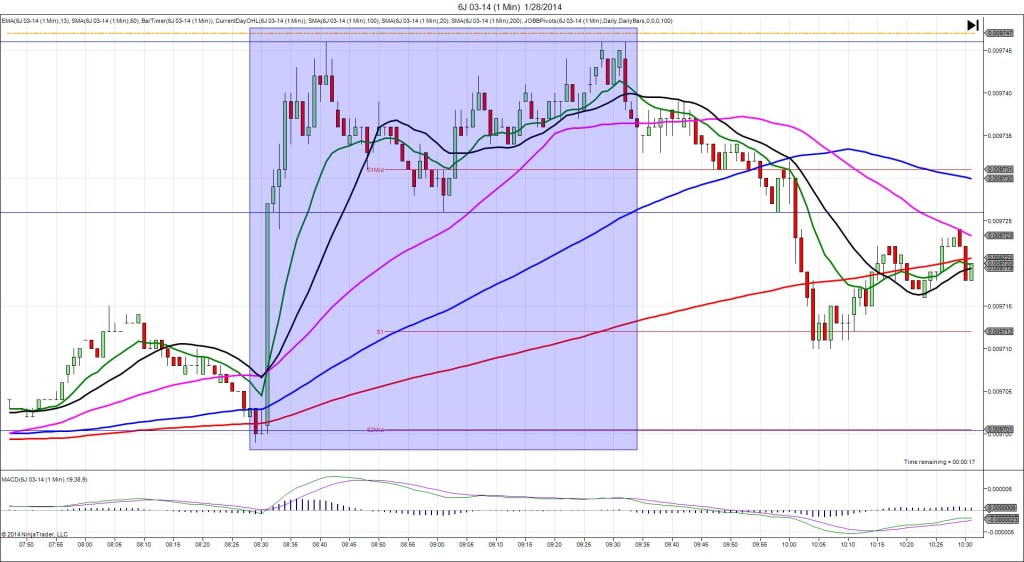

1/28/2014 Monthly Durable Goods Orders (0830 EST)

Core Forecast: 0.7%

Core Actual: -1.6%

Previous revision: n/a

Regular Forecast: 1.9%

Regular Actual: -4.3%

Previous Revision: -0.1% to 3.4%

TRAP TRADE (LOSS – SPIKE WITH 2ND PEAK)

Anchor Point @ 0.0009701 (last price and the S2 Mid Pivot)

————

Trap Trade:

1st Peak @ 0.009716 – 0830:01 (1 min)

15 ticks

Hovered near 0.009717 – 0830:20 (1 min)

2nd Peak @ 0.009728 – 0831:12 (2 min)

27 ticks

————

Final Peak @ 0.009746 – 0841 (11 min)

45 ticks

Reversal to 0.009726 – 0901 (31 min)

20 ticks

Trap Trade Bracket setup:

Long entries – 0.009689 (on the S2 Pivot) / 0.009683 (just below the LOD)

Short entries – 0.009713 (just above the S1 Pivot ) / 0.009720 (no SMA/Pivot within 10 ticks)

Notes: Report came in solidly bearish overall to be the worst setup for the new official trap trade. This caused a quick pop upward for 15 ticks in 1 sec, crossing the S1 Pivot and 100/50 SMAs. With the Trap Trade, you would have filled short at 0.009713, then seen it hover about 4 ticks above the peak for 20 sec. If you noticed the results and perceived that they were consistent and strongly bearish, the wise play would be to exit with a few ticks loss since the likelihood of a quick reversal is small. After the hovering, it jumped up another 12 ticks for a 2nd peak early on the :32 bar which would have filled the outer tier short order with no intervention, Then the stop for the average position would have been taken for a 12 tick loss. It continued to slowly edge higher without any noticeable reversal as it achieved a final peak of 45 ticks after 10 min, nearly reaching the OOD. Then it reversed for 20 ticks in the next 20 min, crossing the S1 Mid Pivot and nearly reaching the 50 SMA.