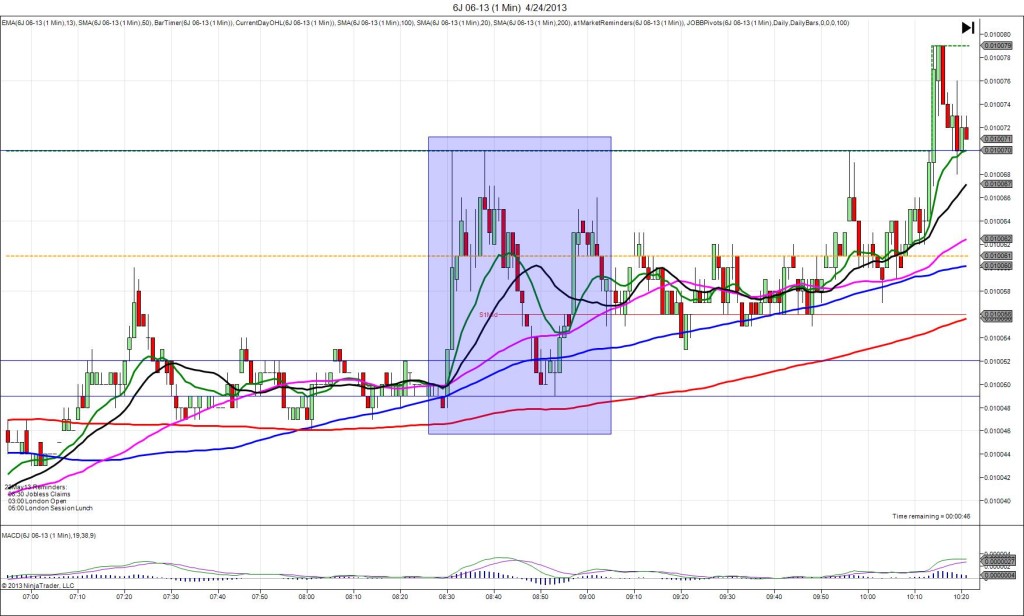

4/24/2013 Monthly Durable Goods Orders (0830 EDT)

Core Forecast: 0.5%

Core Actual: -1.4%

Previous revision: -0.2% to -0.7%

Regular Forecast: -2.9%

Regular Actual: -5.7%

Previous Revision: -0.1% to 5.6%

SPIKE/REVERSE

Started @ 0.010052

1st Peak @ 0.010070 – 0831 (1 min)

18 ticks

Reverse to 0.010049 – 0853 (19 min)

21 ticks

Notes: Report came in solidly bearish and disappointing overall. This caused an 18 tick long move that peaked on the :31 bar, crossing the S1 Mid Pivot and hitting the HOD. Then it surrendered 12 ticks before achieving a double top on the :38 bar. Then it reversed for 21 ticks in 15 min, crossing the 100/50 SMAs and nearly reaching the 200 SMA. After a double bottom, it reversed for 31 ticks in about 10 min to the R1 Pivot. With JOBB, you would have filled long at about 0.010058 with 2 ticks of slippage. Then it popped up to 0.010070 early in the bar and retreated after that. This is a good report to use a profit trigger of about 10 ticks. If you were not quick enough to exit on the :31 bar with more than 5 ticks of profit, wait on the :32/ :33 bars for 5 or more ticks with the large naked wick on the :31 bar.