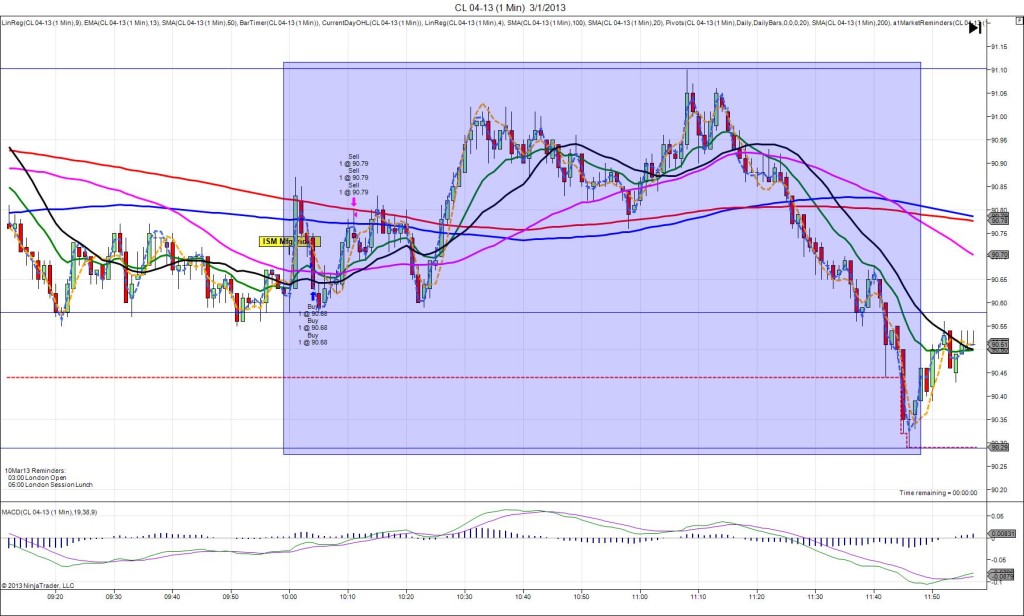

7/1/2013 Monthly ISM Manufacturing PMI (1000 EDT)

Forecast: 50.6

Actual: 50.9

Previous revision: n/a

SPIKE/REVERSE

Started @ 135’12

1st Peak @ 135’06 – 1001 (1 min)

6 ticks

Reversal to 135’22 – 1006 (6 min)

16 ticks

Extended Reversal to 135’28 – 1103 (63 min)

22 ticks

Notes: Report came in nearly matching with only 0.3 pts offset, but above 50.0. We shifted over to the ZB for this report due to the impact of US news on the bonds. We saw a drop of only 6 ticks that crossed the 100/200 SMAs and the S1 Mid Pivot. Then after 30 sec, it reversed and continued on the next 5 bars for 16 ticks. With JOBB, you would have filled short at 135’09 with no slippage. You would have seen it hover between your fill point and 135’06. I would move the stop loss to 135’10 or 11 on the long side of the 200 SMA and place a profit target at 135’07, just beneath the S1 Mid Pivot. If the target was in place before 21 seconds elapsed, it would have filled for 2 ticks, otherwise you would have seen your stop fill for -1 or -2 ticks. Due to the matching news, the DX initially fell, then rallied, causing the ZB to do the opposite. After the initial reversal of 16 ticks in 6 min, it continued higher for an extended reversal of 22 ticks on the 1103 bar at the R1 Mid Pivot.

-120312.jpg)

-110112.jpg)

-100112.jpg)

-090412.jpg)