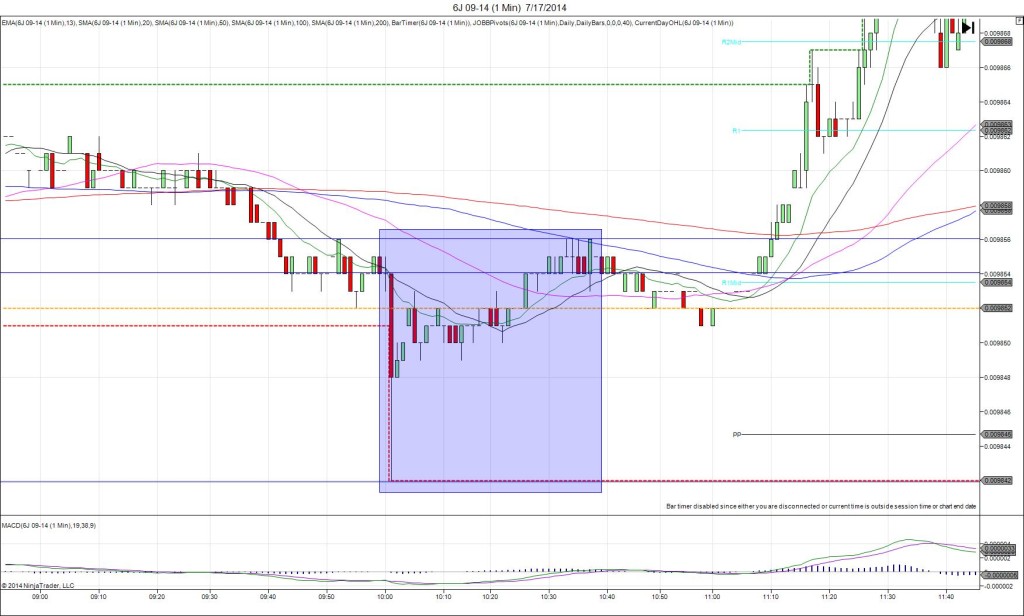

6/26/2014 Weekly Unemployment Claims (0830 EDT)

Forecast: 314K

Actual: 312K

TRAP TRADE (DULL -NO FILL)

Anchor Point @ 0.009832 (last price)

————

Trap Trade:

)))1st Peak @ 0.009837 – 0830:00 (1 min)

)))5 ticks

)))Reversal to 0.009828 – 0830:05 (1 min)

)))-9 ticks

)))Pullback to 0.009839 – 0831:42 (2 min)

)))11 ticks

————

Reversal to 0.009832 – 0836 (6 min)

7 ticks

2nd Peak @ 0.009842 – 0846 (16 min)

10 ticks

Reversal to 0.009836 – 0905 (35 min)

6 ticks

Trap Trade Bracket setup:

Long entries – 0.009823 (on the OOD) / 0.009813 (no SMA / Pivot near)

Short entries – 0.009840 (just above the HOD) / 0.009851 (no SMA / Pivot near)

Notes: Report came in nearly matching with 2K more jobs lost than the forecast. This caused a small long reaction that rose only 5 ticks, then fell 9 ticks immediately. The movement would have been well inside of the inner tiers, so cancel the order. It continued to chop up and down, but the swings were small and contained.