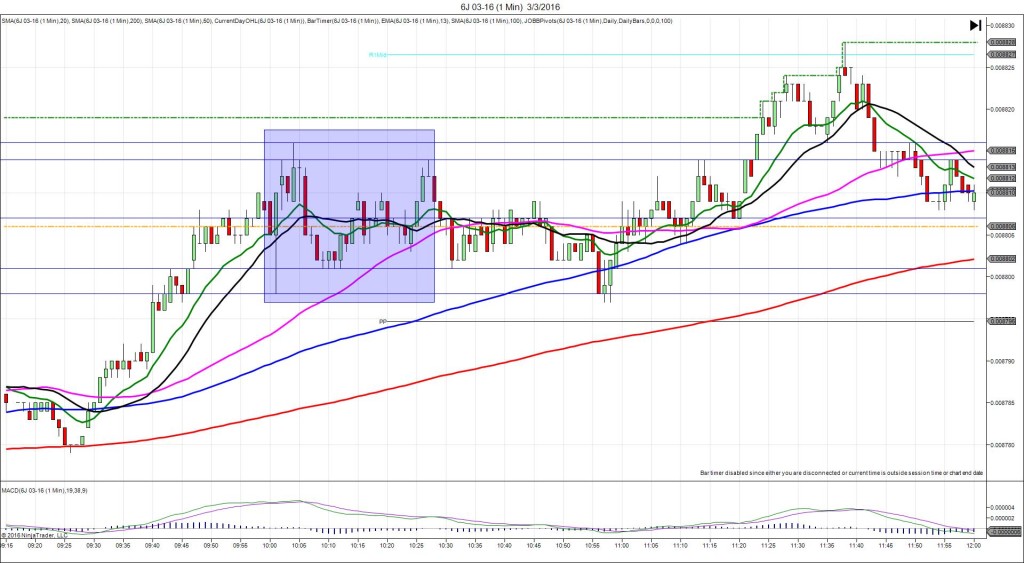

3/4/2016 Monthly Unemployment Report (0830 EST)

Non Farm Jobs Forecast: 195K

Non Farm Jobs Actual: 242K

Previous Revision: +21K to 172K

Rate Forecast: 4.9%

Rate Actual: 4.9%

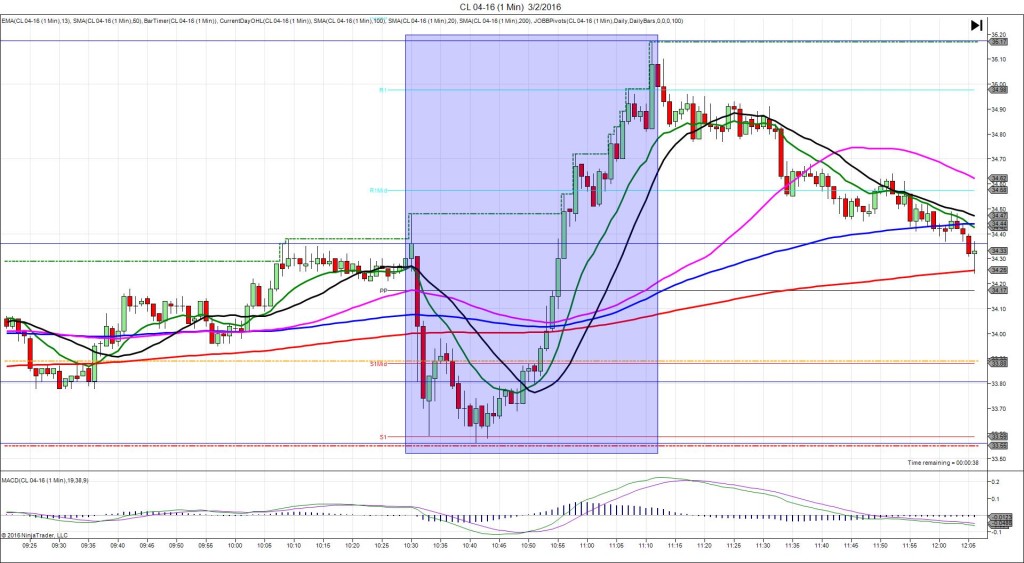

SPIKE WITH 2ND PEAK

Started @ 163’21

1st Peak @ 163’04 – 0830:01 (1 Min)

17 ticks

Reversal to 163’25 – 0830:27 (1 Min)

21 ticks

2nd Peak @ 163’01 – 0831:13 (2 min)

20 ticks

Final Peak @ 162’08 – 0837 (7 min)

45 ticks

Reversal to 163’16 – 0902 (32 min)

40 ticks

Expected Fill: 163’18 (short)

Slippage: 0 ticks

Best Initial Exit: 163’05 – 13 ticks

Recommended Profit Target placement: 163’09 (just below the PP Pivot) / 163’01 (just below the S1 Mid Pivot)

Notes: Strong report caused a moderate short move initially, but it recoiled and fully reversed after about 30 sec. A profit target of 13 ticks or less would have filled. If not filled, look to exit on the hovering at 163’10 at the PP Pivot. If you did not exit, the reversal would have stopped you out with 5 ticks in the middle of the :31 bar. Then it fell strongly again and kept stepping lower for a final peak of 45 ticks in 6 min as it eclipsed the S2 Mid Pivot. After the final peak, it followed the reversal of the equity markets and reversed for 40 ticks to the 200 SMA.