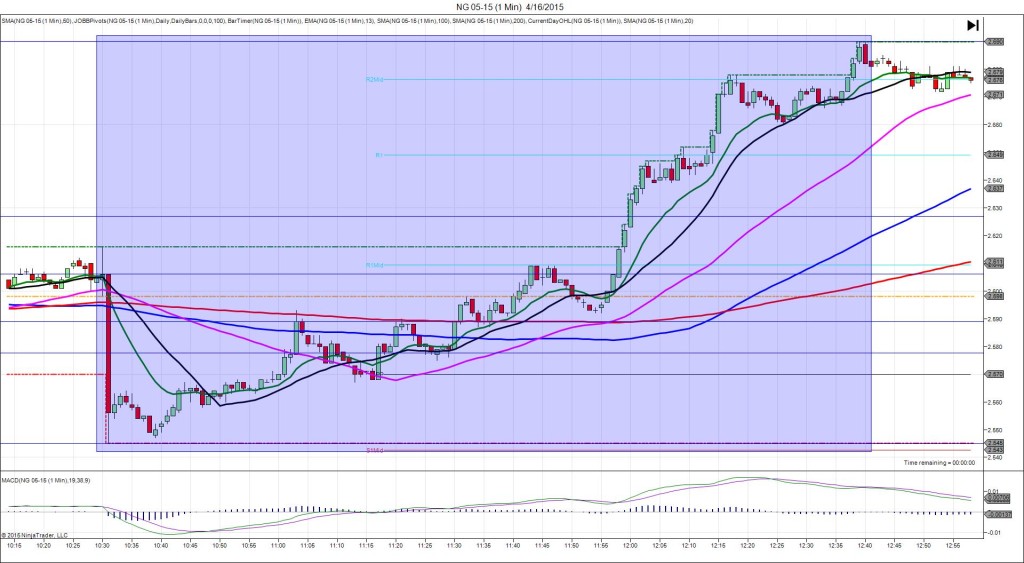

4/16/2015 Weekly Unemployment Claims / Trade Balance (0830 EDT)

Forecast: 284K

Actual: 294K

TRAP TRADE – INNER TIER

Anchor Point @ 0.008398

————

Trap Trade:

)))1st Peak @ 0.008409 – 0830:26 (1 min)

)))11 ticks

)))Reversal to 0.008395 – 0834:26 (5 min)

)))-14 ticks

————

Pullback to 0.008406 – 0841 (11 min)

11 ticks

Reversal to 0.008397 – 0844 (14 min)

9 ticks

Trap Trade Bracket setup:

Long entries – 0.008389 (just below the S1 Mid Pivot) / 0.008378 (just below the S1 Pivot)

Short entries – 0.008407 (No SMA / Pivot near) / 0.008418 (just below the R1 Mid Pivot)

Notes: Report came in worse than the forecast with 10k offset while the concurrent BLDG Permits / Housing Starts also moderately disappointed. This caused a quick long spike of 10 ticks in 1 sec that crossed the 100 SMA then eked out 1 more tick in 25 sec. This would have filled the inner short entry at 0.008407 with 1 tick to spare, then hovered near the top for about 90 sec before reversing 14 ticks in 3 min after crossing the 20 SMA. This would have allowed up to about 10 ticks to be captured with patience. Then it pulled back 11 ticks in 6 min before reversing 9 ticks in 3 min.