6/16/2015 Monthly Building Permits / Housing Starts (0830 EDT)

Building Permits

Forecast: 1.11M

Actual: 1.28M

Previous revision: n/a

Housing Starts

Forecast: 1.10M

Actual: 1.04M

Previous revision: +0.03 to 1.17M

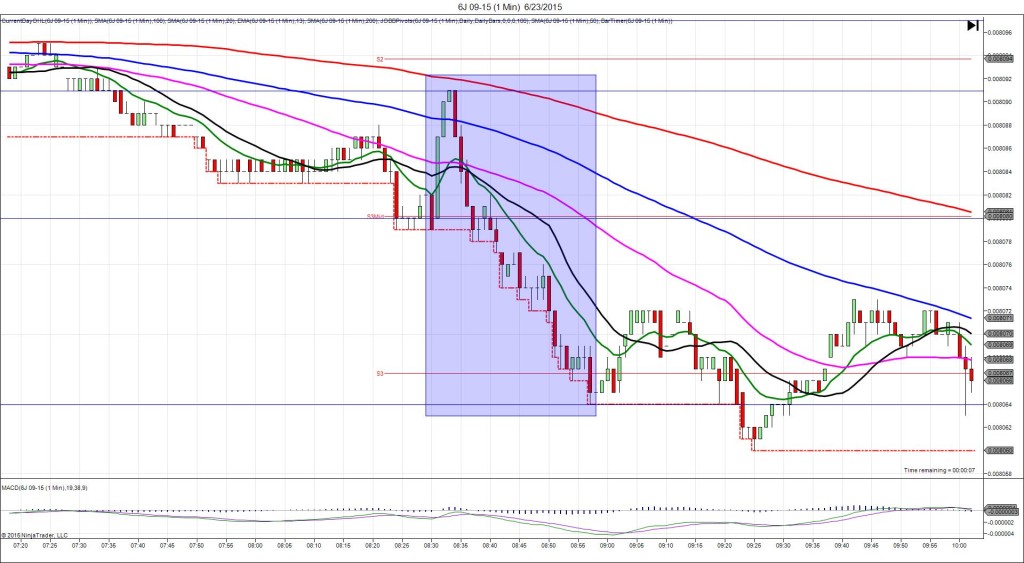

SPIKE / REVERSE

Started @ 0.008110

1st Peak @ 0.008121 – 0830:02 (1 min)

11 ticks

Reversal to 0.008111 – 0833 (3 min)

10 ticks

Pullback to 0.008117 – 0833 (3 min)

6 ticks

Reversal to 0.008110 – 0837 (7 min)

7 ticks

Notes: Report was strongly bullish but also conflicting with the BLDG Permit exceeding the forecast by 0.17M and the Housing starts falling short of the forecast by 0.06M with a large upward revision. This caused a long move of 11 ticks that started just above the 50 SMA and rose to cross the R1 Pivot and extend the HOD. Then it receded and hovered. With JOBB and a 3 tick bracket, your long entry would have filled at 0.008115 with 2 ticks of slippage. Then it backed off quickly to hover at Breakeven to allow an exit with 0-2 ticks. After that it reversed a total of 10 ticks in 2 min to the OOD before pulling back 6 ticks about 1 min later to the R1 Mid Pivot. Then it reversed 7 ticks in 4 min to the 50 SMA and traded sideways.