2/24/2016 Weekly Crude Oil Inventory Report (1030 EST)

Forecast: 3.43M

Actual: 3.50M

Gasoline

Forecast: -1.03M

Actual: -2.24M

Distillates

Forecast: -0.71M

Actual: -1.66M

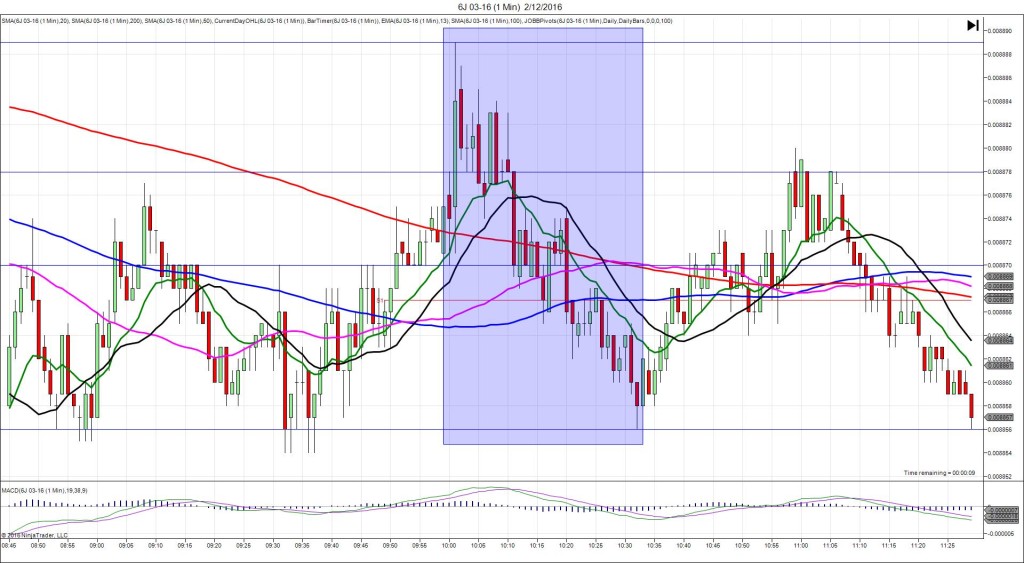

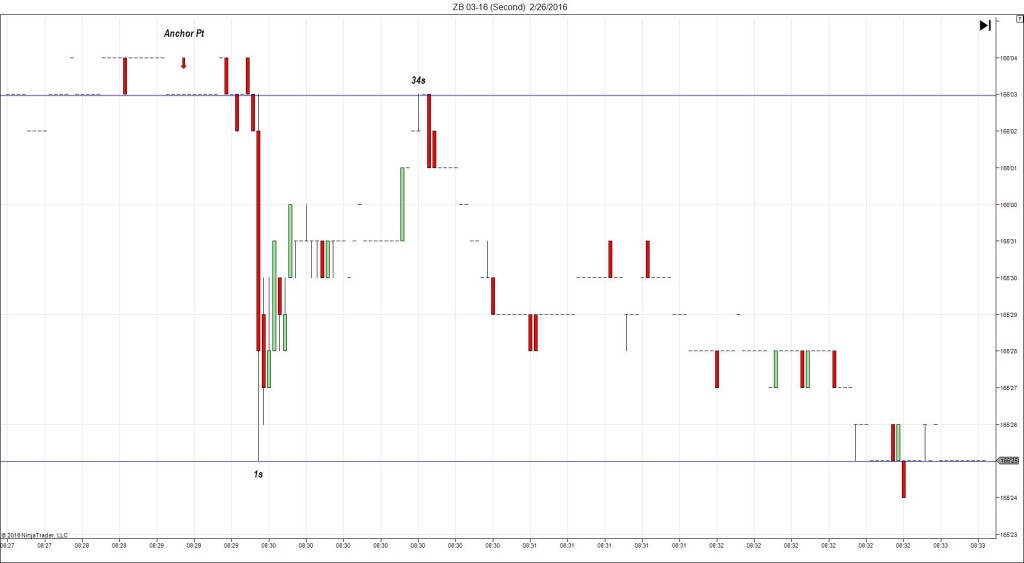

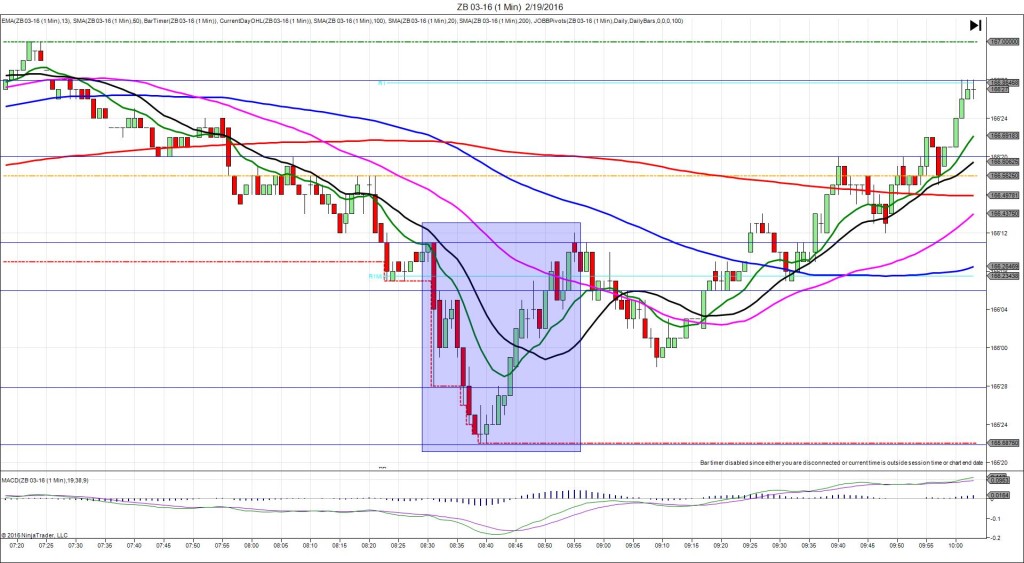

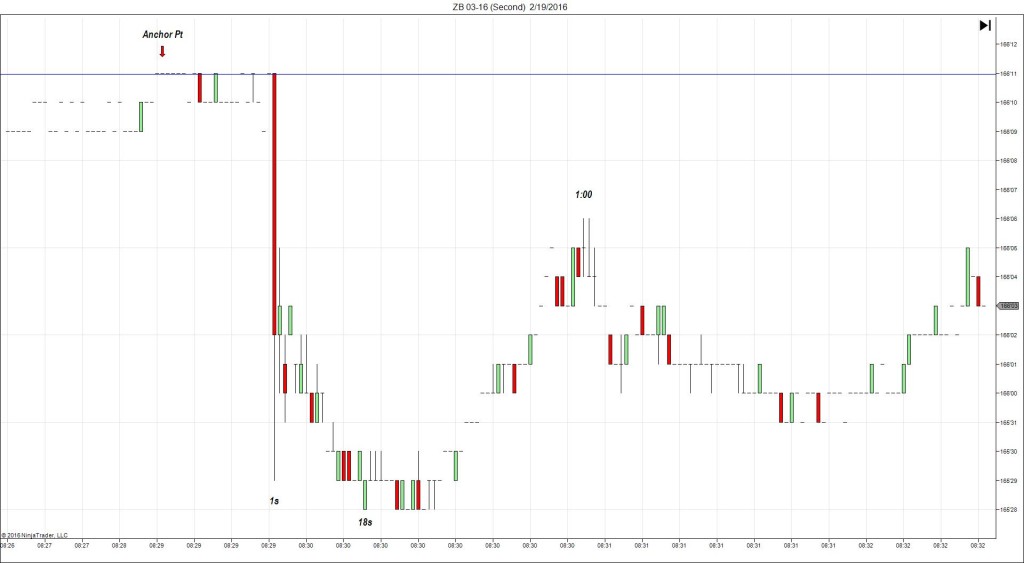

SPIKE WITH 2ND PEAK

Started @ 30.92

1st Peak @ 31.34 – 1030:28 (1 min)

42 ticks

Reversal to 30.78 – 1031:35 (2 min)

56 ticks

2nd Peak @ 31.58 – 1042 (12 min)

66 ticks

Reversal to 30.94 – 1054 (24 min)

64 ticks

Pullback to 31.27 – 1100 (30 min)

33 ticks

Reversal to 30.76 – 1118 (48 min)

51 ticks

Expected Fill: 31.06 (long)

Slippage: 4 ticks

Best Initial Exit: 31.33 – 27 ticks

Recommended Profit Target placement: 31.31 (just above the OOD)

Notes: Moderate long spike peaked at the OOD then hovered before reversing. Then a large reversal to the 3 Major SMAs before a 2nd Peak to breach the HOD. Then it fell strongly off of the HOD to the S2 Mid Pivot.