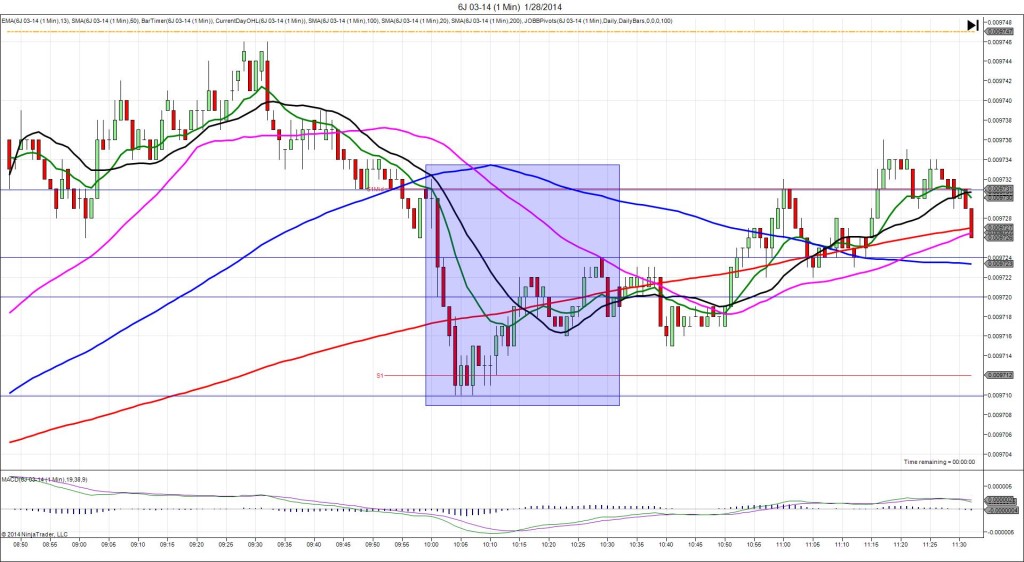

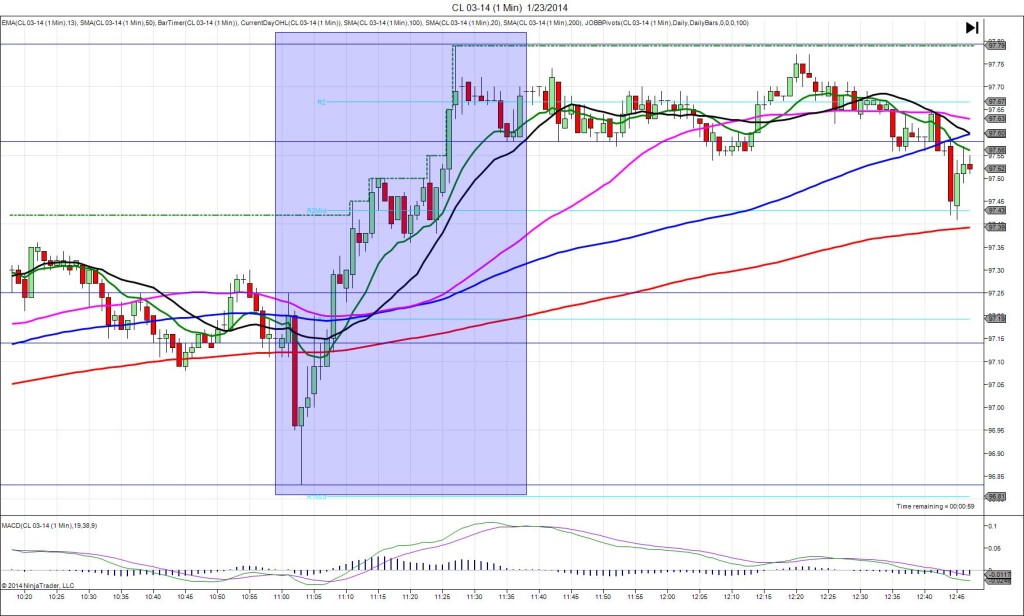

1/28/2014 Monthly CB Consumer Confidence (1000 EST)

Forecast: 78.3

Actual: 80.7

Previous revision: -0.6 to 77.5

SPIKE WITH 2ND PEAK

Started @ 0.009731

1st Peak @ 0.009720 – 1001 (1 min)

11 ticks

2nd Peak @ 0.009710 – 1004 (4 min)

21 ticks

Reversal to 0.009724 – 1029 (29 min)

14 ticks

Notes: Report exceeded the forecast by a small margin of 2.4 points. This caused a 11 tick short spike on the :01 bar that was tame and sustained, as it started on the falling 13 SMA, and ran out of momentum just before reaching the 200 SMA. With JOBB you would have filled short at 0.009725 with 2 ticks of slippage, then seen it fall a few more sticks and stall at about +4 ticks. With the 200 SMA looming lower, you would be safe to grab a few ticks and exit at about 0.009721. Without much of a reversal, it continued lower for another 10 ticks on the next 3 bars, crossing the 200 SMA and the S1 Pivot. After that it reversed for 14 ticks in the next 25 min, as it reached the 50 SMA.